Theme Festival - Unscripted Programming

With unscripted content now challenging glossy dramas for primetime slots, industry executives debate the rise of premium factual, feel-good viewing and turning scripted IP into new formats.

There has rarely, if ever, been a better time to be in the business of making unscripted content. Global streaming platforms have a seemingly insatiable appetite for documentaries, while gameshows and shiny-floor formats are being licensed worldwide and reality TV continues to attract the elusive younger audience.

Meanwhile, blue-chip wildlife series now benefit from state-of-the-art filming techniques and technology, while A-list Hollywood talent are putting movies on hold to make premium factual passion projects, such as Lord of the Rings director Peter Jackson’s docuseries The Beatles: Get Back for Disney+ in 2021.

It’s a far cry from the days when drama overwhelmingly dominated the primetime schedules of linear channels, and producers of unscripted content could only dream of attracting as many eyeballs as police procedurals or soap operas.

Certainly, the rise of VoD services have been at the heart of this renaissance. Visit the Netflix homepage and both the Top 10 and Trending Now sections are full of dating reality formats, extreme survival shows, fly-on-the-wall sports docuseries and, of course, true crime.

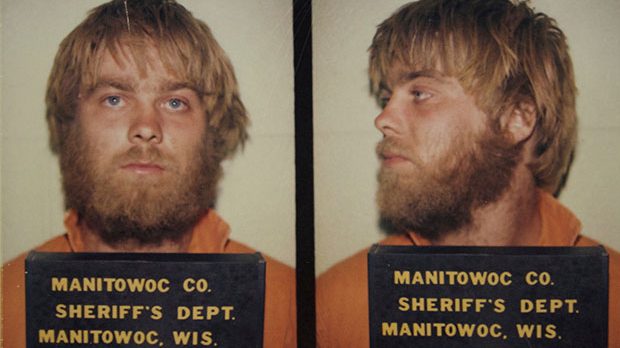

“Until recently, everybody was trying to find the next Making a Murderer or Tiger King,” says Olivia Deane, senior analysist at UK research firm Ampere Analysis. “A total of over 2,000 true crime docs have been produced, so it’s still the most commissioned unscripted genre on the streamers, but our research shows that it’s declining slightly.

“The sort of things I’m seeing more of are arts and culture documentaries, factual programming with a socio-political focus and – perhaps in reaction to world events and the economic situation – a trend for more light-hearted but hopeful shows. Viewers want to believe that society is a nice place.”

Data collected by Ampere shows that unscripted titles represented 73% of all commissioning announcements in January of this year, with 1,105 green lights. Of those titles, 34% were documentaries, 30% fell under the bracket of entertainment and 25% were reality shows.

Perhaps surprisingly, national broadcasters are outstripping the streamers when it comes to commissioning unscripted, with the UK’s BBC and Channel 4, plus France Télévisions and Italy’s Rai ordering more programmes in this space than Netflix between 2020 and 2022.

The trend for cosier content and socially conscious programming has not gone unnoticed by industry veterans, who view the shift as a sign of the times.

“When the world gets too dark, TV audiences seek out lighter stuff such as non-scripted entertainment,” says Bo Stehmeier, CEO at Amsterdam-based distributor and producer Off the Fence, which specialises in factual content such as the Oscar-winning Netflix doc My Octopus Teacher. “We saw that during Covid and we’ll see it again this year, as a result of recession, the war in Ukraine and the Turkey-Syria earthquake.

“And when people are worried about the world, they lean towards the factual space and documentaries to figure out what’s going on – they’re seeking ‘infotainment.’

“People are intrigued by how to enrich their lives, so I think we’ll see more observational docs where people are learning how to re-train as a plumber, for example, or business-related docs on how to operate a corner shop or a bed and breakfast hotel.

“I also believe we’ll start seeing more family-friendly content like Married at First Sight and Love Is Blind – returnable reality shows with certain format beats.”

These themes were reflected at the recent London TV Screenings, where BBC Studios (BBCS) created bespoke preview events to shop two new formats: gameshow Breaking Point, being produced for RTL in Germany, and Ultimate Wedding Planner.

These shows complement BBCS’s existing roster of hit formats such as Strictly Come Dancing (aka Dancing with the Stars), which is now licensed in 61 territories; The Great British Bake Off, which is rapidly nearing 40 local adaptations; and new addition The 1% Club, made by Magnum Media for ITV and being adapted in Germany and Australia.

“A fantastic format is always going to pop,” says Matt Forde, MD of global productions and formats at BBCS. “It’s not a coincidence that Dancing With the Stars and The Great British Bake Off continue to do so well – they’re just wholesome, positive shows. People are enjoying pure entertainment.

“I think there’s a slight tailing off in the reality space, as some of those shows are waning in popularity.

“Overall, I think what unscripted has proven, both in the UK and US, is that for less money, you can deliver as many or possibly more eyeballs than scripted drama or comedy. It really feels like the playing field has levelled up.”

At NBCUniversal (NBCU)-owned Universal International Studios (UIS), senior VP of creative for unscripted programming Ed Havard has delivered two winning formats: the UK versions of reality gameshow The Traitors and the Mo Gilligan-fronted variety show That’s My Jam, both for BBC One.

Both formats arose out of a collaboration between NBCU and the BBC, initiated in 2001, to find unscripted shows that could work on both sides of the pond.

“That’s My Jam and The Traitors have both done very well for us,” says Havard, who previously held senior roles in unscripted at the BBC and Channel 4. “The success of those shows builds momentum, galvanises the market and instils huge confidence in the unscripted space.

“We’re going to see more appetite for dramatic competition shows with narrative arcs and social experiment dimensions. The Traitors is on NBCU’s Peacock platform and shows like that can be the Holy Grail for the streamers because they lend themselves to being binge-watched and travel very effectively across multiple territories.”

Another new emerging trend is to take scripted IP and find innovative ways to exploit it in unscripted. Netflix, for example, will soon launch Squid Game: The Challenge, a reality gameshow based on the hit South Korean drama Squid Game and produced by Studio Lambert (The Traitors).

Amazon Prime, meanwhile, is developing James Bond spin-off 007’s Road to a Million, a Race Across the World-style travel competition show produced by the UK’s 72 Films and MGM Television.

NBCU is set to join the fray soon too. “NBCU is home to some of the biggest global franchises in the world, so exploiting our IP in the unscripted space is a real priority for us,” says Havard. “I can’t give anything away right now, but we’re working closely with our scripted partners to maximise the scripted IP we have within the NBCU ecosystem.”

Go back 20 years and a great deal of documentary content could be described as fast-turnaround TV, hastily cobbled together from archive footage, ‘talking head’ contributions and a voiceover trying to make sense of the hotchpotch package.

Now it is an entirely different story, with ‘premium factual’ an often-repeated buzzphrase heard at industry events since last year. This genre is typified by carefully curated passion projects, often filmed over several years by acclaimed directors, featuring celebrity narrators, expensive soundtracks and dazzling cinematography – not to mention higher budgets.

At NBCU-owned European pay TV platform Sky, executives prioritise unscripted in the company’s content commissioning strategies. “Factual is the second most important genre to our customers,” says Zai Bennett, MD of content for Sky UK and Ireland. “The very best factual is about dramatic storytelling – when you watch this content it’s just like scripted drama.

“For Sky Documentaries, we’re only operating in a world of definitional pieces, feature docs and miniseries. The factual shows we’ll have on air in 2023 will be beautifully made, director-led pieces that have taken multiple years to develop.”

Recent successes for Sky have included last year’s nuclear disaster doc Chernobyl: The Lost Tapes, which also streamed on HBO Max. New projects for 2023 include Zuckerberg: King of the Metaverse, about Facebook creator Mark Zuckerberg’s life and career, and Hijacked, a feature doc that tells the story of Palestinian terrorists storming a Pan Am passenger jet in 1986.

As well as commissioning wildlife shows for Sky Nature, the company also took the decision to make Sky Arts a free-to-air channel, featuring new 2023 projects such as rock doc series Brian Johnson & Mark Knopfler’s Good Times, plus 6×60’ ornithological series Painting Birds with Jim and Nancy Moir.

“Sky Arts’ demographic is a bit older and more upmarket,” says Bennett. “There’s an eclectic mix of content, which has allowed the shows to grow and flourish. People love the specificity of detail, being able to get into something deeply and go on a journey.”

For producers and distributors in the factual field, success can often come down to finding a balance between short-run premium projects and more reliable returnable brands.

The former attract publicity and acclaim but often represent a slim return on investment, while the latter often go under the radar but quietly pick up multiple commissions around the world.

At London-based development, financing and distribution company BossaNova Media, CEO Paul Heaney has curated a catalogue that includes both premium titles such as Con Girl (4×60’), about serial fraudster Samantha Azzopardi and made by CJZ for Paramount+, and numerous multi-series brands such as Border Patrol, Highway Cops and The Casketeers.

“Streaming platforms spend a lot of money to get noisy, access-led miniseries or features that create a temporary spike in eyeballs but are never going to return,” says Heaney. “They can be great, but you can’t have too many because I don’t want to be in the vanity game, taking a premium title just so I can preen my feathers and peacock down La Croisette at Mipcom with a bottle of champagne.

“It can be better in the long run to have returnable, repeatable, scalable series such as your Extreme Tow Truckers and Border Patrols. Shows like that have emotional involvement and build engagement, which in turn drives audiences. Those brands might not be as fashionable as noisy premium factual shows, but at least the viewers aren’t going to just disappear after three or four episodes.

“Looking into my crystal ball, I can see spin-offs of successful ongoing brands being in demand, plus more factual shows about societal issues such as the environment and climate change. Male-skewing factual entertainment could be big because there’s not enough supply in that genre.”

With the industry this year facing economic headwinds and a possible US writers’ strike, commissioners are less likely to be greenlighting expensive drama shows. As a result, cheaper unscripted content is likely to be in great demand as the year goes on.

However, execs warn that this feeding frenzy will lead to huge competition among producers and distributors to super-serve the market.

“I always used to think this business was like a bear pit, but now it’s more like the UFC,” says Heaney. “I hope we can help commissioners’ budgets go further, but at the same time it’s getting harder to finance projects.

“As regards the economy, there were some problems last August, September and October, but it’s really picked up since November and I can’t see it slowing down. At BossaNova, we’ve done more revenue in the last two months than all of last year.”

Others believe unscripted execs can’t afford to be complacent and may yet find their own shows’ budgets constricted, mirroring the cuts in drama finance. “We’ve had around eight years of booming budgets – but a price correction is coming, if it isn’t already here,” says Stehmeier.

“Recently, everything needed to be €800,000 [US$851,000] an episode, while back in the day we could make very solid TV for €90,000 an hour. I think there will be an increase in demand for anyone who can produce for around €175,000 to €200,000 per hour.

“New types of storytelling will emerge from that as you have to deal with the craft differently, but for those who can work in that budget bracket, the boom in unscripted can go on for at least another five years.”