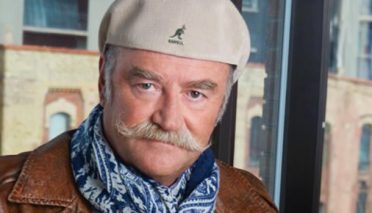

Peter Wassong explains how a new approach at Deutsche Telekom has resulted in the launch of Netflix across the German telco’s CEE footprint.

Peter Wassong

This year has been a landmark one for Deutsche Telekom in Central and Eastern Europe (CEE), with the German telco expanding its partnership with Netflix across several countries.

Starting with Hrvatski Telekom in Croatia and Magyar Telekom in Hungary, Deutsche Telekom’s subsidiaries have introduced new ways of integrating the US streaming service into their own platforms, including bundling or setting up features on their TV interface.

According to Peter Wassong, head of TV content for Europe at Deutsche Telekom, who was the architect of the expanded partnership, it marks a change of approach by the company.

Previously, “every country was negotiating with content partners on their own without talking to anybody else,” he explains. “All attempts to negotiate with Netflix and Disney+ had always failed because, in the end, the size of the market was way too small for the OTT partner.”

To change this, Wassong says Deutsche Telekom decided to turn things upside down by creating a new type of partnership in which the parties would look at Europe as a whole. In effect, the company told Netflix: “We can give you X million euros, we can give you X thousand subscribers, and that’s across the footprint.”

Deutsche Telekom also offered Netflix a dedicated team at its headquarters to manage the partnership, which basically told the streamer: “You talk to us and we do the rest internally.” This was “the logic that also made it possible for Netflix to see that this would works for them.”

Having launched Netflix in Croatia and Hungary, Deutsche Telekom plans to add the service to other countries in its CEE footprint later this year and in 2025.

All told, the company is active in nine European pay TV markets aside from Germany, the others being Austria, Poland, Hungary, Slovakia, the Czech Republic, Greece and a ‘cluster’ in the Balkans, consisting of Croatia, Montenegro and North Macedonia.

Significantly, the telco already offers Warner Bros Discovery-owned streamer Max in all the CEE markets where the streaming service is available. This, Wassong points out, is largely a consequence of the historic relationship the telco has with HBO. At the same time, it only offers Disney+ in Austria, thanks largely to a distribution agreement in place for Germany.

Greek crime series The Other Me from Deutsche Telekom’s subsidiary OTE

Wassong says that Deutsche Telekom’s footprint is quite fragmented in CEE, with Hungary and Greece having the most mature TV markets and the deepest integration within its telco business. Poland is becoming a strong TV market despite Deutsche Telekom having only recently introduced its services there, while in other parts of CEE, especially smaller territories such as Montenegro and North Macedonia, it just aggregates channels.

Greece is an outlier, says Wassong, in so far as it’s the only market where Deutsche Telekom’s subsidiary OTE Group is directly involved in content production. Aside from having its own studio responsible for sports programming, it has produced crime mystery series The Other Me and coproduced the Apple TV+ series Tehran, shot wholly on location in Athens, for which it provided logistics.

OTE also operates the channel Cosmote History, which was launched eight years ago at the peak of the financial crisis in Greece. Entirely focused on Greek history, culture, customs and tradition, the thinking behind it was “to make people believe in the achievements of their own country.”

Wassong says he “thoroughly believes” in producing local content, but at the same time acknowledges it is difficult for the content to travel to other Deutsche Telekom markets because of their different backgrounds. “It really must be super local, because people love local storytelling, local stories, local history. And then it works.”

What is more, he believes the telco is unlikely to start producing content in other markets as it, to some degree, lacks the expertise, logistics and infrastructure in those markets.

OTE shot Apple TV+ series Tehran on location in Athens

Looking more broadly at the main issues currently facing the industry in CEE, Wassong identifies piracy and trying to convince people that content comes at a cost. Another is cost pressures as local content is becoming increasingly expensive. “And I’m talking about not just 5% or 10% per year,” rather “content providers who believe they can double or triple the prices from period to period sometimes.”

This clearly makes life difficult, and Wassong believes: “You can only win this war with partnerships.” As an example, he cites the broadcaster Central European Media Enterprises (CME), which is present in six CEE markets and has been historically strong in Slovakia and the Czech Republic.

“If you look at the market share of CME’s commercial channels in Slovakia and the Czech Republic it is pretty clear you cannot live without them,” continues Wassong. “They have great content, they have local content, local storytelling. They have also a lot of local sports and international sports.”

At the same time, Deutsche Telekom controls the distribution in the two countries, and a “Mexican stand-off” between the companies to find out “who blinks first” would clearly not work. This is why they cooperate, with the telco supporting CME with its streaming service Voyo.

Wassong also makes the point that Deutsche Telekom operates in relatively low average revenue per user markets, with its TV offerings being typically in the €8 to €10 a month range.

“If you look at the price levels in these markets, it’s getting increasingly difficult to integrate and bundle the streamers into the proposition, especially when they become bigger and bigger,” as in the case of Max, he says, which is in effect a merger of HBO Max and Discovery+.

That is why, Wassong says: “I like smaller, cheaper OTT services, because it’s easier to put them into bundles and put them into our offerings.”

Cosmote History looks at Greek history, culture, customs and tradition

Wassong cites Netflix’s basic €4.99 offer as a good example of such a service, contrasting it with one that may, for instance, cost €12.99 a month. He also points to the rise of local streamers such as CME’s Voyo, which is even bigger than Netflix in Slovakia. “They all get stronger and more relevant. Our task is to find smart alliances with them.”

In his view, as a telco, Deutsche Telekom has the additional advantage of not only bundling TV and OTT services but also including broadband and mobile in its quad-play offer.

Looking to the future, he rules out expansion into other territories in CEE, or indeed leaving those in which it is currently present. Most recently, it left the broadband and TV market in Romania and is now in the process of selling the mobile part of its business in that market.

Deutsche Telekom is, meanwhile, continuing to pursue what Wassong describes as a “One TV” strategy that aims to have a TV platform in all markets, scaling devices and making partner integration easier.