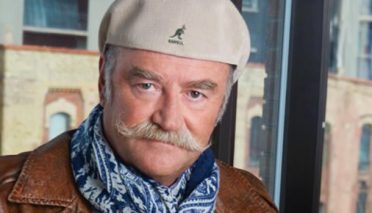

Rising costs and disappearing Czech TV channels are among the main issues facing the Slovak cable industry, says UPC Broadband Slovakia MD Martin Miller.

Rising costs and disappearing Czech TV channels are among the main issues facing the Slovak cable industry, says UPC Broadband Slovakia MD Martin Miller.

UPC Broadband Slovakia is US cable giant Liberty Global’s last remaining asset in Central and Eastern Europe (CEE), with the company having sold its operations in Hungary, Romania, the Czech Republic and, most recently, Poland within the past five years. While the former were acquired by Vodafone, the latter, known as UPC Polska, was bought by France’s Iliad.

Martin Miller

UPC Broadband Slovakia traces its roots back to 1999, when United Pan-European Communications completed the acquisition of a 95.63% stake in Slovak company SKT to create the country’s largest cable TV operator. It subsequently developed its offering to also include satellite TV, broadband internet and fixed-line telephony services.

Today, according to MD Martin Miller, it provides subscribers with 200 TV channels of all genres, ranging from news to sports and documentaries, with 120 being in HD. Among these are some of the most watched channels in Slovakia, including the Czech channels of public broadcaster Česká Televize; the JOJ Group’s JOJ Cinema, JOJ Plus and WAU; and Central European Media Enterprises (CME)’s male-skewing channel Dajto, the younger-orientated Doma channel and TV Markiza.

CME’s flagship Slovak channel, Markiza airs a mixture of local and international shows, including CBS’s The Mentalist, Czech crime drama Specialist (Specialisté) and Voyo original miniseries Iveta.

UPC Broadband Slovakia also offers seven-day replay TV services, and Miller notes: “We can say that we are the most significant operator offering local TV services.” All told, UPC Broadband Slovakia distributes some 30 regional and city TV channels across the country.

Czech crime drama Specialist (Specialisté)

Miller adds that the company also offers high-speed broadband and passes 600,000 homes, offering all its services on its footprint. Meanwhile, outside its footprint, the UPC TV app gives customers access to all the operator’s TV channel line-up irrespective of which ISP they use to receive them.

Most recently, UPC Broadband Slovakia introduced a mobile service, working in partnership with the telco Swan. “We are basically the resellers,” continues Miller. “We are aiming to offer our customers quad-play. This is quite successful, and we are very happy that, after so many years of offering our customers triple-play, right now we can also offer them mobile services.”

Significantly, UPC Broadband Slovakia does not offer streaming services such as Netflix and Disney+, as “we don’t have the scale,” says Miller. It does, however, sell Warner Bros Discovery streamer Max directly to its subscribers.

Miller believes that while Slovaks “love streaming services,” they cannot afford to take them all and then have a monthly bill of €100. “So they are shopping around, looking for the best content and, at the end of the day, they will keep two of them.”

The two leading local streaming services in Slovakia are currently Voyo and JOJ Play, operated by national commercial broadcasters TV Markiza and JOJ respectively. Miller says it is inevitable that linear TV channels will have fewer viewers “and have to convert their customers to their streaming service.”

They will want to have direct contracts with those customers “and I actually tell them they should do so and find out how difficult it is to deal with the churn, sale, cross sale and so on,” Miller says, adding that this will make customers “realise what kind of value I am offering them for a monthly price, because those two local services will cost them much more in the future.”

US import The Mentalist

Despite this, Miller believes these local streaming services will remain and linear customers will convert to them. The process is likely to take five to 10 years, after which linear TV “will be just used for commercial and cross-selling purposes.”

Miller also speaks positively about Czech TV channels, which “have a lot of fans in Slovakia” and account for around 20% of total viewership in the country.” He continues: “There is nevertheless pressure from Slovak commercial broadcasters on operators to stop carrying these channels, or at least limit them, as they show foreign films and series to which the Slovak broadcasters have licensed rights. Miller also notes that they “would like to have that 20% and monetise it.”

Moreover, in February this year the Czech public broadcaster Czech TV (CT) wrote directly to Slovak operators asking them to immediately stop the distribution of CT Sport, one of its thematic channels. This gave them no legal option but to comply with the request and resulted in Slovak viewers losing yet another Czech channel.

At the time, UPC Broadband Slovakia expressed surprise at CT becoming part of the campaign to withdraw Czech channels from the Slovak market after having been present there for many years.

Miller says the operator is “very proud and very happy” to carry Czech channels, especially as there is nostalgia for the former Czechoslovakia – the Czech Republic and Slovakia were formed following its peaceful dissolution at the end of 1992 – and its customers are demanding to have them and to keep in touch with the Czech Republic through CT.

Miller is also of the view that the biggest issue currently facing the cable industry is the mounting fees charged by programmers. “In the beginning of the cable industry in Slovakia, we had a growth margin of 90%. That margin is shrinking and broadcasters are being really harsh and increasing their prices more than usual,” he says. In practice, this amounts to more than 10% a year “and this is something we can’t justify,” the exec adds.

Voyo original miniseries Iveta

As a result, he continues, customers are being left unhappy because operators are having to drop some channels from their offers on the grounds of cost. “I expect this is going to continue and in the future there will be a clash with broadcasters and this will make our lives in the industry quite difficult,” Miller says.

Miller also believes sports programming will become increasingly popular in Slovakia. “What we have seen in the US for years is coming to Slovakia and Central Europe,” with new owners of sports franchises, typically from the US, “able to commercialise sport in the way that they are creating an event the viewers will want to see.”

Alongside this, he expects the popularity of news will decline, with viewers preferring the sort of entertainment that sport offers. However, this too will lead to financial pressures on cable operators.

Miller insists broadband internet is “definitely” UPC Broadband Slovakia’s future. “We will keep the TV and voice services as long as we have to, but our customers will need more speed, more data and better connectivity, and we are about to be able to sell them more of that with the service.”

While he doesn’t see TV as declining, he believes it is becoming less important. This is certainly the case among younger viewers aged 20 to 25, who while they still want the option to watch TV can find content online if it’s not available in the linear world.

Ultimately, UPC Broadband Slovakia’s TV and voice services will be complementary, and it will be more important to have a quality broadband service.