With the launch of its streaming platform, Warsaw-based Canal+ Polska has caught up with the times and now has a business with “two legs,” says president and CEO Edyta Sadowska.

With the launch of its streaming platform, Warsaw-based Canal+ Polska has caught up with the times and now has a business with “two legs,” says president and CEO Edyta Sadowska.

Canal+ is a long-standing player in the Polish television market, having made its debut as a single channel in 1995 before growing over the next few years through acquisitions.

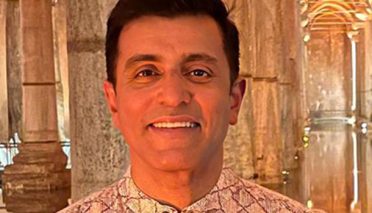

Edyta Sadowska

One of these was Wizja TV, which subsequently merged with Canal+’s business in 2002 to create a DTH platform called Cyfra+, says Edyta Sadowska, president and CEO of Canal+ Polska. There was a further merger, with another DTH operation known as n, to create nc+. “This platform is the base for the business we have today,” she explains.

Significantly, as recently as four years ago, Canal+’s DTH platform was the only business it had, distributing its channels on other platforms thanks to agreements with cable operators and telcos. It then took the “very important” decision in May 2020 to launch a streaming platform, called Canal+.

“It was pretty late and a brave decision, as first of all it was during the pandemic and, secondly, we were one of the last on the market to launch,” says Sadowska.

Looking at the DTH sector in Poland, Sadowska adds that it is currently served by the platforms Canal+ and Cyfrowy Polsat. The former accounts for 20% of pay TV subscribers and the latter over 30%, with cable operators and telcos claiming the remainder.

However, Canal+ has more customers watching premium content – and willing to pay for it – than Cyfrowy Polsat.

Although Polsat’s initial strategy was to target the non-premium part of the market, it has since evolved, with one of its milestones being securing the broadcasting rights to the UEFA Champions League.

It then started to create premium channels, two of them, branded Polsat Sport Premium, offering coverage of the competition and shared with Canal+. “That was, in fact, the first deal that I did at Canal+,” says Sadowska, who has been in her current position at the company since 2018.

Canal+’s version of The Office comedy format proved a hit

The significance of the agreement with Polsat was that it was struck in the first year that Canal+ customers found themselves without coverage of the Champions League. Important though this was, Sadowska stresses that the company’s main focus in the last few years has been the changes happening in the market, especially regarding technology and customers’ behaviour. It became clear that DTH was not enough, so the next step was to launch Canal+ online.

As a result, its business now has “two legs”: a DTH platform that is basic, traditional and distributed by cable operators and telcos, and Canal+ online, different to other streaming services on the Polish market but similar to Polsat’s Polsat Box Go.

Sadowska adds that while all the main platforms on the market, including Netflix and Disney+, are mainly focused on films and series and are without live channels, “our platform is the platform that has everything they have but we have much more, because on the platform we have live channels, live channels with sport, documentaries, different genres and, of course, we have the VoD content that the others have.”

Indeed, in her view, Canal+ online can more accurately be described as “modern TV and internet” rather than a streaming platform because it offers the traditional TV viewing experience of live channels as well as films and series in the same way global streamers do.

What it doesn’t have, however, is free, ad-supported streaming TV (FAST) channels, despite their growing popularity. “We don’t need them because we have live channels, because, for us, FAST channels are a replication of live channels. There are plenty of live channels and it makes no sense to put FAST channels on the platform.”

“The most important thing for me,” continues Sadowska, “is to be technologically agnostic.” Content is the main part of Canal+’s product, and technology gives access to it. “That is why we have to be up to date with all the technologies present on the market,” addressing “big shifts” from DTH to fibre, for instance.

Comedy Emigracja XD follows two young Polish men in London

Sadowska also stresses the importance of experimenting with content. “The difference is that on the DTH platform, you can always support your offer with the offer from others, because you are selling a package – not only your channel but other channels as well. On the streaming platform, your content is the most important.”

Canal+ acquired a majority (70%) stake in the Polish film producer and distributor Kino Swiat in November 2019, raising its share to 86% the following year. This gives it access to local content, “which plays a very important role for us.”

Sadowska highlights several Polish films and series that Canal+ has produced or coproduced in the past few years. These include the Agnieszka Holland-helmed Green Border and Chlopi (The Peasants), an animated historical drama film made by Poland’s BreakThu Films supported by Canal+, and with Serbia’s Digitalkraft and Lithuania’s Art Shot also listed as coproducers. It made its internet and TV premieres on Canal+ online and Canal+ Premium in January. Both films were box office hits in Poland.

She also says that 2023 was the year Canal+ tried to push comedy. It experimented with The Office format, which despite doubts in the past as to whether it would work, “proved to be a big success on the Polish market with the first season. We are very proud of that.”

Another comedy title it had a hit with was Emigracja XD, a series following the experiences of two young Polish men in London.

Sadowska says that Canal+ has also recently found success with the thriller series Sortownia, produced jointly with Polsat, and has been experimenting with sports documentaries.

The exec also believes there are plenty of synergies, especially on the content side, with other Canal+ Group subsidiaries such as SPI International and Kino Polska. Canal+ is also looking closely at Viu, the Asian streaming platform in which the group increased its stake to 30% this February, to learn from its success.

Thriller series Sortownia was coproduced with Polsat

On the advertising side, Canal+ now finds itself working with the broker Polsat Media, which since the beginning of this year has been selling ad time on Canal+’s Polish channels. This follows a tender announced in June 2023 in which Polsat Media, TVP Advertising Office and previous contract holder TVN Media took part.

Significantly, when DTH customers in Poland subscribe to Canal+ they also gain free access to Canal+ online. “This is important for us because we think these customers can be transformed into digital customers,” says Sadowska. “We are trying to teach them how to use the new technology.” The biggest priority is nevertheless “to show them our content. We are a content company.”

Looking to the future, she believes the Polish streaming market, which is currently served by 12 platforms, is set for consolidation, with half of them disappearing, “and to some extent specialisation in the market as well. Because it’s impossible to have 12 platforms all doing the same films and series. We are all doing the same. Even though I’m telling you we are focusing on local content, all the players in the Polish market are focusing on local content.”

It is too expensive to be totally exclusive, which means “you have to have some exclusivity in specific segments. You have to create the niche of your business and you have to be different from the others in that niche.”

At one stage there was an idea for TVN and Polsat to launch an all-Polish streaming platform. In Sadowska’s view, this was a missed opportunity and, despite consolidation being the future, there is still a place for such as service in the market.