The combination of strong local production, international partnerships and premium sports has helped Baltic OTT service Go3 achieve a market-leading position, according to CEO Jan Wykrytowicz.

The combination of strong local production, international partnerships and premium sports has helped Baltic OTT service Go3 achieve a market-leading position, according to CEO Jan Wykrytowicz.

Go3 began 2024 with the announcement that it had become the leading streamer in the Baltics, racking up half a million paying subscribers less than four years after launch. It was a major milestone for the OTT service, born out of Providence Equity Partners’ €115m (US$130m) buy-out, in 2017, of Modern Times Group (MTG)’s broadcasting businesses across Estonia, Latvia and Lithuania.

Jan Wykrytowicz

“Achieving 500,000 subscribers wouldn’t be possible without our passionate and talented team, amazing content, distribution partnerships and world-class technology,” said Go3 CEO Jan Wykrytowicz, hailing the news.

Arriving at this point, whereby Go3 has reached 20% household penetration among a Baltic population of some 6.5 million people, has been a complicated endeavour involving the gradual unpicking, realignment, refinement and relaunch of MTG’s Baltic interests.

The 2017 transaction was facilitated via Providence’s prior takeover of Lithuanian telco Bitė Lietuva and purchasing three MTG TV channels in the territory (TV3, TV6, TV8), three in Estonia (TV3, TV3+, TV6), and five in Latvia (TV3, TV3+, TV6, Kanals 2, LNT). Pan-Baltic pay TV enterprise Viasat and several streaming services were also included as part of the mix.

Sweden’s MTG (these days called Viaplay and still in a perpetual state of restructuring) had been a player in the Baltics since 1996. Back then it introduced free-to-air network TV3 to Estonia and moved into streaming in 2009, with the roll-out of AVoD platform TV3Play across the region, followed by SVoD service Viaplay in 2016.

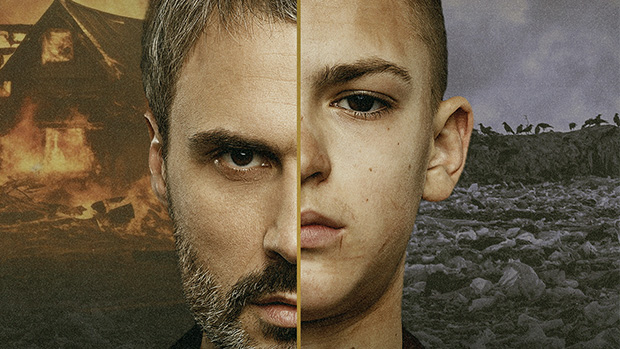

Chornobyl 2022 Invasion was inspired by true events

So when Providence and Bitė bought MTG’s Baltic assets the year after, a new company called All Media Baltics was born. This was then renamed TV3 Group a few years later – reflecting the original channel’s heritage – while Viaplay was subsequently rebranded under the Go3 banner in the three countries, though the process of transitioning subscribers from one to the other continues (more on this shortly).

“We are one of the few territories in Europe where a local OTT player has battled back against the global giants like Netflix,” says Wykrytowicz, adding that there are a number of factors that distinguish Go3 from such potential disruptors.

“Go3 is not completely standalone from the legacy parts of our business. It’s close to the TV3 free-to-air operations and benefiting both from the marketing power and content production and commissioning capacities,” he says. “On top of that, we are part of a larger group with a telco in place, so this is a dream set-up, because we are part of an extended family where there is a big push and focus on distributing our OTT.”

In concert with all of this, the TV3 Group and Go3 have developed a content strategy that Wykrytowicz argues has also played a pivotal role in getting the business to where it is today. Key has been investment in local programming. More than 260 series spanning over 1,000 hours have so far been branded as Go3 originals: shows like People of the Dump (Siukslyno Zmones) – an adaptation of the novel of the same name by Lithuanian author Edmundas Zenonas Malūkas; hedonistic, supernatural Gen Z drama New Norm; and Chornobyl 2022 Invasion, a coproduction inspired by true events depicted in an earlier documentary from Latvia’s Cinevilla and Ukraine’s UM Group.

“We do a lot of Go3 originals and 90% of them are coproductions with free-to-air colleagues,” says Wykrytowicz. “Those productions naturally get their first window on SVoD, OTT, on the Go3 platform and then after six or nine months on free TV.

“Moreover, we invest a lot into long-term projects, so we don’t produce many one-off series or movies. We usually look at commissioning a couple of seasons and this set up allows us to launch the second on OTT while at the same time the previous one is being launched on free-to-air, and that boosts viewership of both.”

Supernatural Gen Z drama New Norm

Indeed, Wykrytowicz says that rather than experiencing a decline in audiences, as is the case across much of the TV industry, this symbiotic relationship is in fact driving an uptick. Last year, Go3 reported the highest weekly and monthly viewing figures in its history with customers watching on average more than 3.5 hours per day.

But it’s not only homegrown shows that get all the credit. While Wykrytowicz talks of ‘battling back’ the likes of Netflix, he is keen to point out this isn’t really an accurate characterisation of Go3’s relationship with the heavy-hitters of US media and entertainment.

“It’s worth saying that the Baltics are small countries – altogether six-and-a-half million people, with three languages across three nations, so not such attractive markets for big global players,” he says. “If you look at Netflix and Disney+, they’re not even localised for all three countries. You can watch them but in English, or other languages, not local. So what’s even more important for us is partnerships with these players to localise their content, push it through local context and local culture.”

Go3 has such partnerships in place with Paramount and Warner Bros. Discovery’s Discovery+ and HBO – brands that are at different phases of roll-out in the CEE region than they are elsewhere, with the introduction of Max.

“We are in a in a slightly different situation than other bigger markets where there is more of a clash between local and global players,” Wykrytowicz continues. “We are a very good launchpad for them and they are a very good complement to us. This aggregation element is equally important as producing and commissioning local content.”

The third pillar of the Go3 and TV3 Group content strategy is sport.

“If you look at how Viaplay rolled out, they didn’t progress much in our territories. They are very focused on sports, but even with sports, you need to understand the local flavour, speak the local stars’ language, you need to find the local angle, not just bring the largest sports competitions in the world like the Premier League or Champions League,” says Wykrytowicz.

People of the Dump, another Go3 original

He takes basketball as an example: “Basketball is like a religion in Lithuania so local relevance is critical even in such a global area as sports. As a broadcaster, as a media company, we need to be close to the action, close to the team, close to the key stars, and that’s what builds your position.”

This being said, as part of its ongoing retrenchment to key Nordic territories, Viaplay recently signed a deal to sublicense its Baltic live TV rights to the English Premier League, UEFA Champions and UEFA Europa Leagues, NHL, Formula 1 and others to Go3. There is still an undisclosed number of Viaplay subscribers in Estonia, Latvia and Lithuania and these will be transitioned to Go3 during March, delivering another boost to its customer base.

“Go3 will further strengthen its position as the ultimate destination for all sport fans in the Baltics,” says Wykrytowicz. “The package will be available for both existing and new Go3 customers, who will be able to freely combine it with other available packages.”

While there is much to celebrate, the exec is of course mindful of events outside the sports and entertainment arenas. Many in Estonia and Latvia speak Russian and after the country invaded Ukraine two years ago, Go3 and TV3 Group took the decision to drop all Russian programming from its outlets.

“It’s one thing to watch Russian-originated content, and another to watch with Russian localisation. Some players in these markets used to have 30 or 40 Russian-originated channels on the platform, and this demand stays. It doesn’t disappear together with the war, so there was an outflow of customers to pirated services. But we as a group, made a decision to drop the content no matter the price,” says Wykrytowicz.

“We partnered with Ukrainian content providers and kind of replaced the Russian content with Ukrainian content, which quite often comes with Russian language. It was the right decision.”

While the war rages on, other challenges for TV3 Group, according to Wykrytowicz, include being wary of the fact that while Go3 is enjoying a period of growth, consumers are becoming more cautious about their spending.

“If you look at the OTT streaming platforms, there are two baskets – one is ‘must-have’ and the other is ‘nice-to-have’, on top of those essential services. For us, it’s really important to get into the ‘must-have’ basket and we need to do it fast, and not be in the basket of services they cut first. That’s what we’re getting ready for.”