While Warner Bros Discovery may have significantly scaled back investment in scripted in CEE, its general manager for the region, Jamie Cooke, is targeting more unscripted content and docs that push boundaries and address current affairs, true crime and topical issues.

Jamie Cooke

Local, local, local. Attend any TV conference on either side of the pandemic and you would hear it from every stage: if you want to succeed with local audiences, you must super-serve them with local content.

However, Warner Bros Discovery (WBD)’s Jamie Cooke notes that despite the media giant’s decision to halt local scripted content in Central and Eastern Europe (CEE), it hasn’t seen a decline in subscriptions or engagement as a result.

For Cooke, who as group senior VP and general manager is responsible for WBD’s business across CEE, the Middle East, North Africa and Turkey, this indicates the importance of the quality of content over where it originated from. WBD’s strategy in those regions is now being shaped with this in mind.

Cooke and WBD are now looking to strike the right balance between big-ticket global IP, such as The Last of Us, and a peppering of distinctive local content, mostly unscripted, to achieve profitability for the media group, which is looking for billions in savings.

The now-shuttered HBO Europe had a major presence across CEE, operating production bases in Poland, Hungary, Czech Republic and Romania, making it a leading commissioner of scripted TV in the region.

However, streamer HBO Max (now known as Max) halted the development of original content in most of Europe following the merger of Discovery and WarnerMedia in April 2022. It was devastating news for producers in CEE, who had come to rely on HBO as a primary commissioning and coproduction partner for originals.

“Shutting down the scripted part of our HBO series in CEE was a difficult decision, but we had to look at the data and it wasn’t profitable,” said Cooke at a recent event in London.

“In terms of balancing global versus local, a lot of data analysis is done. Our KPIs [key performance indicators] globally are about profitability in streaming, as well as scale and engagement. That doesn’t mean we’re not doing local content, but we have to balance it out.”

The Last of Us performed better than local Turkish shows on BluTV

Cooke gave the example of Turkish SVoD service BluTV, which WBD acquired in December 2023. The takeover of the platform came after WBD launched streamer Discovery+ on BluTV in 2021 and took a 35% stake in the company. One of the components of the 2021 partnership was the option to invest more in BluTV, which resulted in the full acquisition of the service.

Recent research revealed HBO’s post-apocalyptic drama series The Last of Us performed better for BluTV than “between nine and 12 local Turkish productions combined,” said Cooke. “It made us think, ‘Hang on a minute, what is the right blend between global and local content?’ We’re trying to figure that out.”

Speaking to CEE21.com, Cooke says he believes the lines between local and global content are becoming increasingly blurred, particularly with localisation technology using artificial intelligence to dub programming for audiences around the world.

“It’s very difficult to say whether a local content strategy or a global content strategy is the right one. It has to be a balance between the two,” says Cooke.

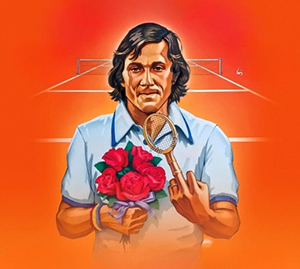

Nasty: More Than Just Tennis about tennis star Ilie Năstase

While there’s no current focus on local high-end scripted content in CEE, WBD remains open to ideas, particularly those that could drive Cooke’s priorities of profitability, engagement and scale. “I don’t want to stop ideas flowing to us as a company,” the exec says, emphasising the importance of local content to free-to-air networks like WBD-owned TVN in Poland.

Meanwhile, Cooke remains on the hunt for unscripted programming in CEE for its portfolio of linear channels and streaming service Max, which was recently rebranded in the region to incorporate Discovery+.

Max in Hungary launched a local version of Banijay unscripted format The Bridge last year, while boundary-pushing documentaries, as well as sports and true crime docs, are the three pillars for WBD’s local unscripted output in the region, given their ability to reflect regional interests.

For example, Nasty: More Than Just Tennis, a documentary about Romanian tennis legend Ilie Năstase, was coproduced by Libra Films with Max and Televiziunea Română (TVR) and has drawn critical acclaim. Cooke also points to Emma & Eddie: A Working Couple, which follows a couple out to save their marriage by starting their own adult web studio in Eastern Europe.

The docs come as WBD has expanded its offering to viewers in CEE with the launch of 15 TVN-branded free, ad-supported streaming TV (FAST) channels in Poland and its first free-to-air (FTA) TV channel in the Czech Republic, Warner TV, which arrived in April.

The 15 FAST channels are available on local streaming platform Player and cover a range of themes. They include TVN Fan-Favorite Series (comedy-drama), TVN Moments of Truth (scripted reality), TVN Law & Life (law-themed scripted reality), TVN School of Life (YA) and TVN Heroines (romance).

Others include TVN Soap Operas, TVN Hospital Drama, TVN Talk Shows, TVN Crime Mysteries, TVN Boujee Lifestyle, TVN Fix It, TVN Love in Paradise, TVN At Home, TVN Culinary Extravaganza and TVN Thrills On Wheels.

The Hungarian version of unscripted format The Bridge

The content on the channels has been sourced from WBD and its wider FTA networks, such as TVN, TTV, TVN7 and Metro.

Meanwhile, Warner TV became WBD’s first FTA TV channel in the Czech Republic, where it already operates 18 linear pay TV channels and Max. It is the second market after Italy where Warner TV is available FTA and the 11th in EMEA where Warner TV is available.

Despite it being “very early days,” Warner TV has thrown up some interesting curveballs when it comes to what Czech audiences are looking for. Fringe, the US sci-fi show that ran on Fox for five seasons between 2008 and 2013, has been a surprise success story in the Czech Republic so far, says Cooke.

“We have a lot of that content from the Warner library. It’s surprising what you learn once you start to put the content out there,” says Cooke. Such quirks may be music to the ears of companies with deep libraries of content but painful to indies with new projects on their slates.

Piracy was a major talking point at C21’s Content Warsaw in June, where governments and advertisers were urged to act over what delegates and speakers labelled a huge problem in CEE.

Emma & Eddie: A Working Couple follows a husband and wife who start their own adult web studio

Cooke believes legitimate streaming platforms also have a responsibility to make as “compelling” an offer as possible all in one place to encourage consumers to pay for content, rather than pirate it.

“We obviously need to fight piracy because it’s bad for the industry overall. But there is a limit to what legislation can do. Companies need to offer something worth paying for and make it available. It’s going to take time but that’s how the issue will get resolved,” says Cooke.

He points to Max pulling together content from both HBO Max and Discovery+ as an example, as well as the potential for bundling, as WBD is doing in the US alongside The Walt Disney Company to offer Disney+, Hulu and Max together. Could a similar move happen in Europe?

“It’s too early to say. It’s still being figured out in the US. What I would say is that particular bundle is a really interesting concept. The team and I are talking to partners about figuring out if it’s a route to go down or not,” says Cooke, declining to reveal which partners WBD is talking to.

Clearly, Cooke sees bundling as the natural evolution of the industry’s business model as it seeks a stable footing following streaming’s disruption of the pay TV model that served traditional players so well and continues to endure in CEE.