US kids’ commissions decline, acquisitions on the up

Ampere Analysis principal analyst Fred Black was at Kidscreen in San Diego this week talking about how the dearth of commissions in US children’s content is being mitigated by a boost in content acquisitions in that sector.

While US studios “aren’t commissioning new kids’ content,” thanks to the faltering economy, they are acquiring “like never before,” according to Fred Black, principal analyst at UK research firm Ampere Analysis.

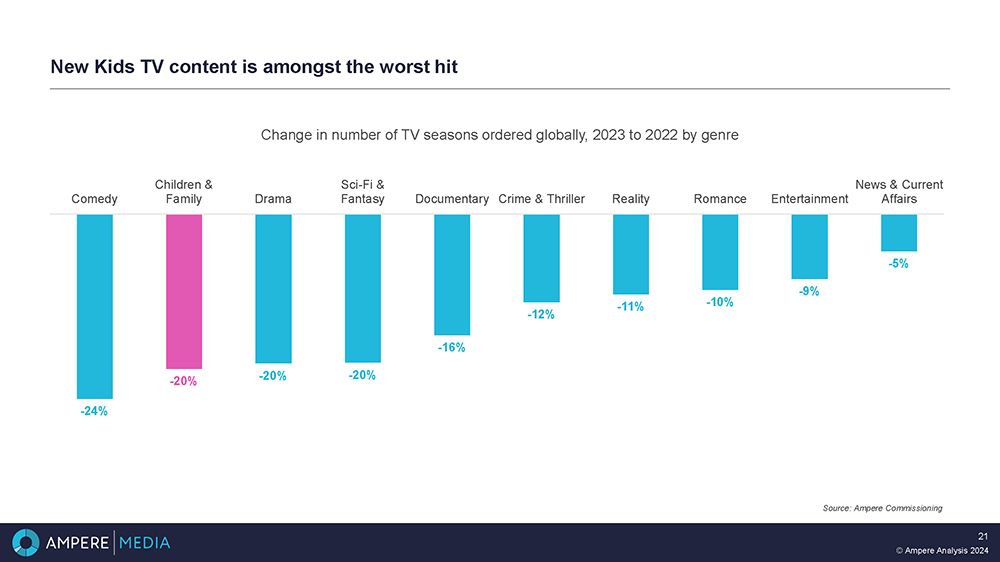

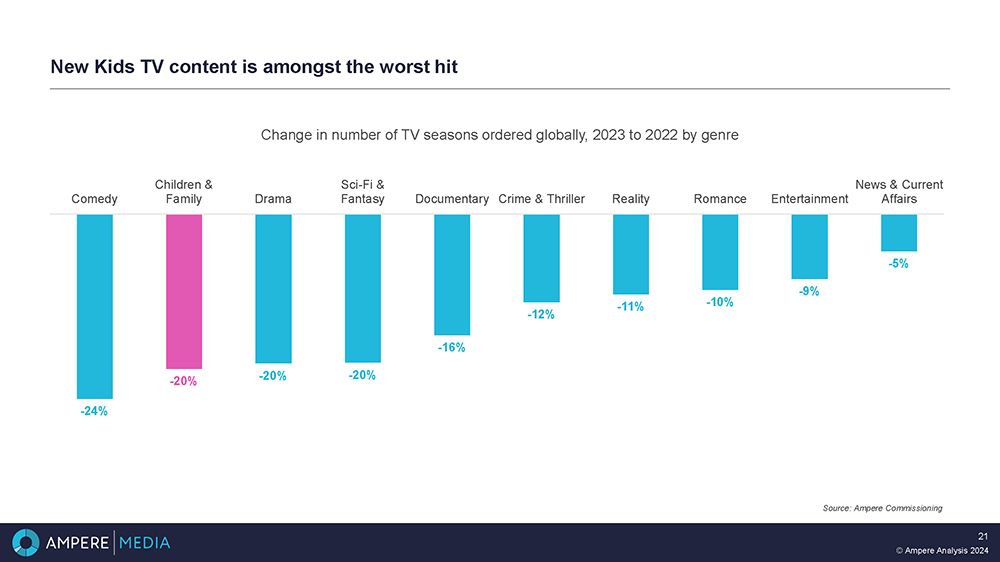

Kids’ TV programmes have been among the worst hit in the commissioning slump across the content industry. The number of children’s and family TV seasons ordered globally in 2023 declined by 20% when compared to 2022, according to Black’s presentation to delegates at Kidscreen Summit in San Diego on Monday.

The figure was the same in drama, sci-fi and fantasy, while comedy had the biggest decline at 24%. Although documentary, reality, romance, crime and thriller, entertainment and news/current affairs also experienced decreases, they fared better, relatively speaking.

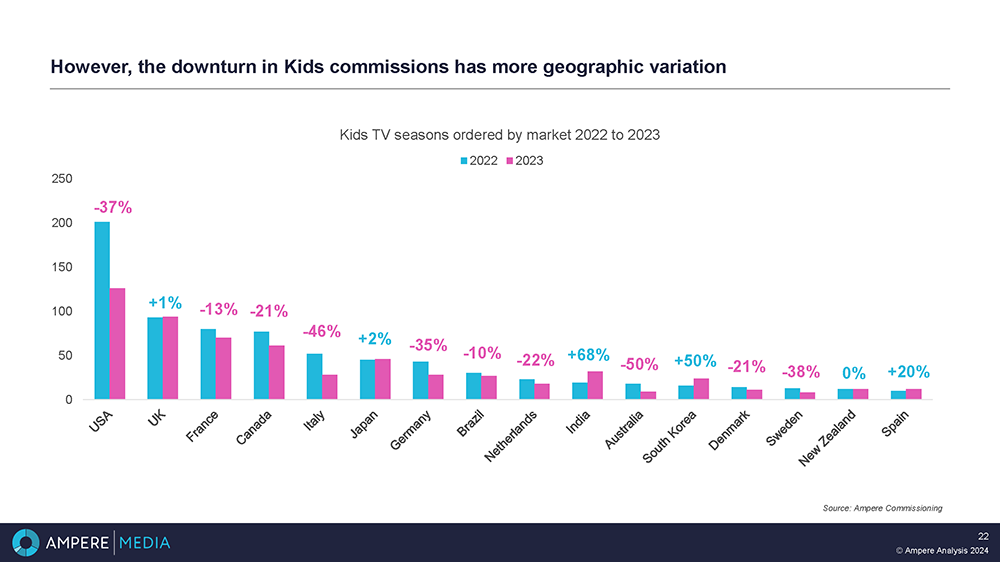

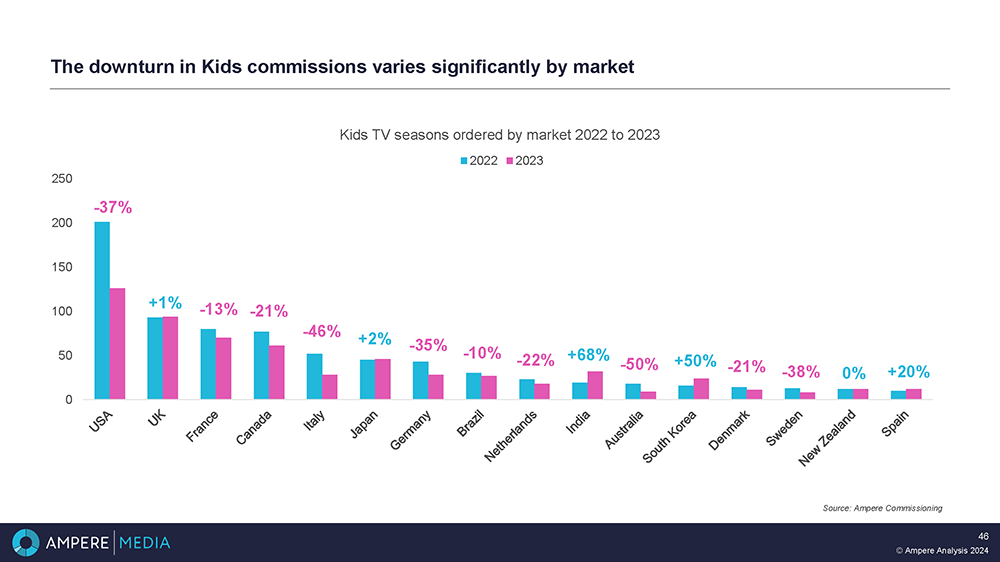

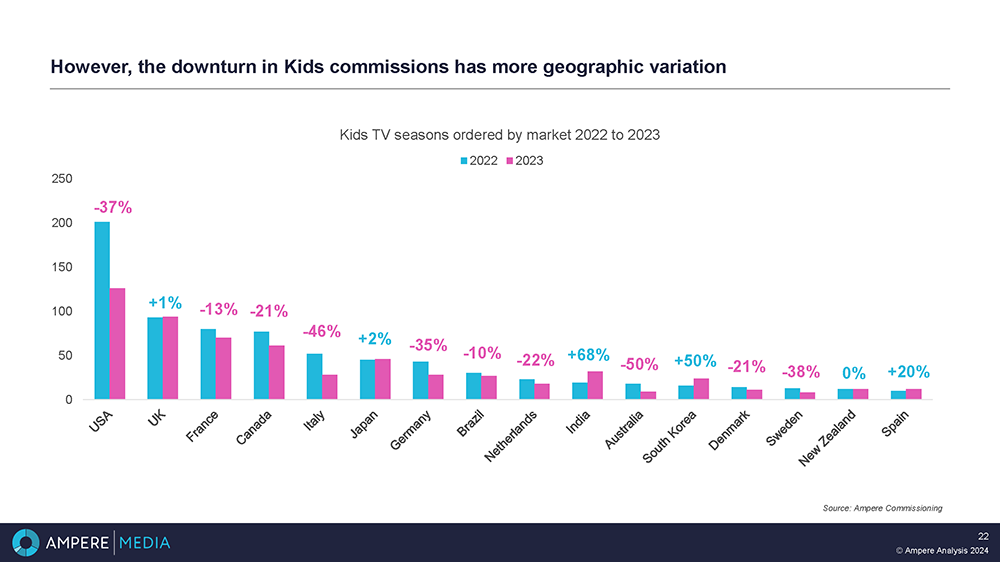

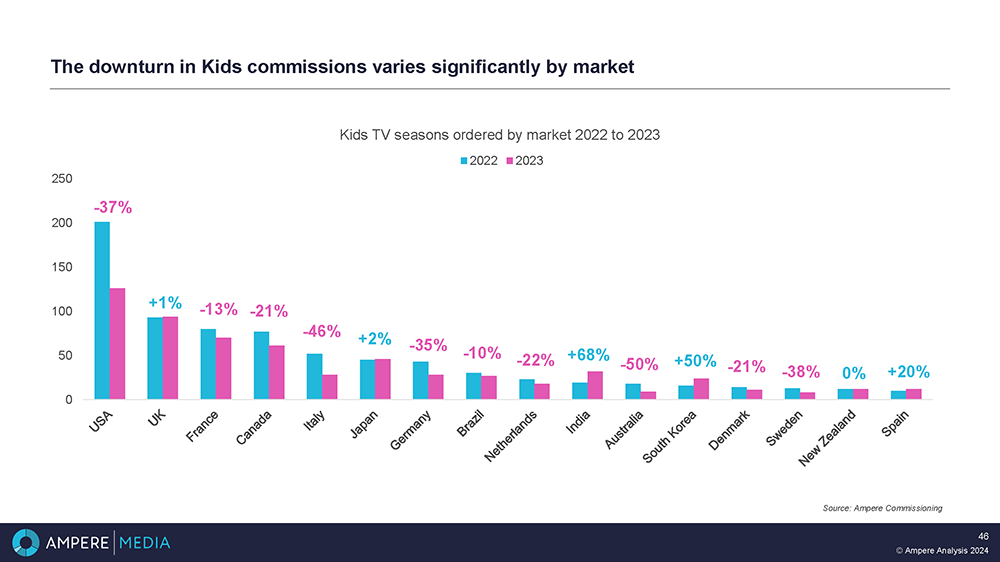

Geographically, the number of children’s TV commissions in the US fell by 37% in 2023, with France falling 13%, Canada 21%, Italy 46%, Germany 35%, Brazil 10%, the Netherlands 22%, Australia 50%, Denmark 21% and Sweden 38%.

The number of kids’ commissions grew, however, by 68% in India, by 50% in South Korea, and by 20% in Spain. There was marginal growth of 1% in the UK and of 2% in Japan, while New Zealand remained flat.

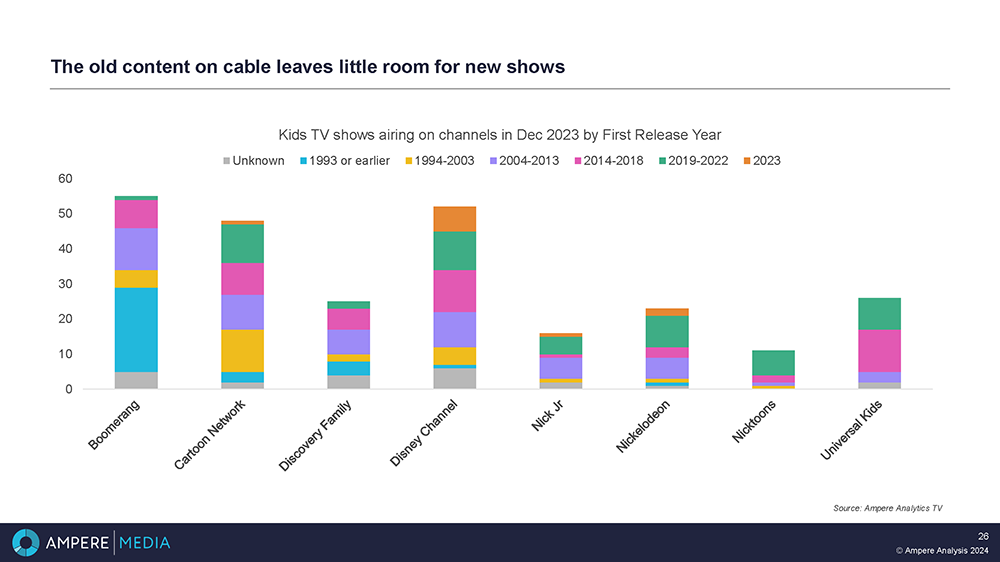

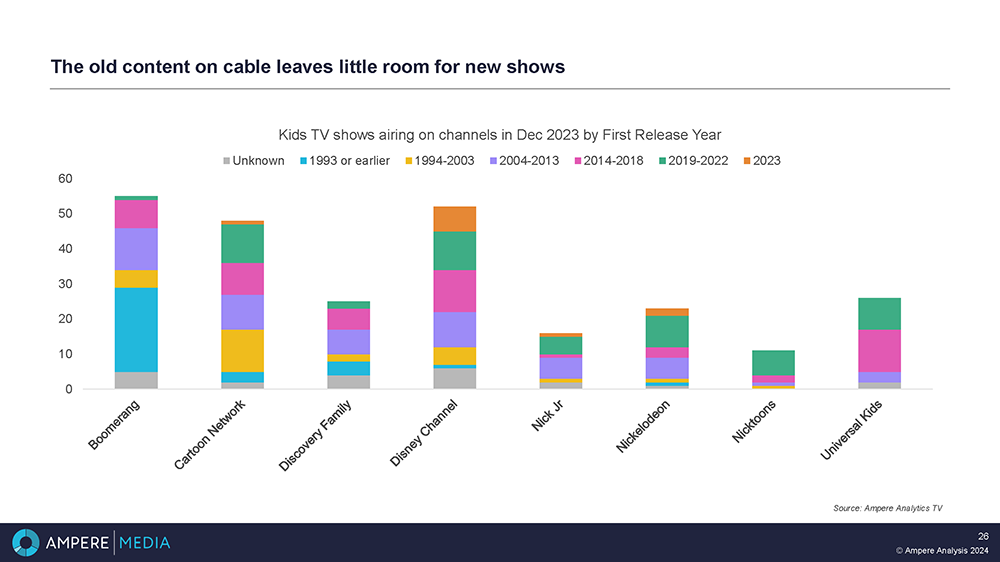

Zeroing in on the US, Black said older content on cablenets has left little room for new shows, with programmes released before 2019 making up a big chunk of the offerings on Cartoon Network, Disney Channel, Nick Jr, Nickelodeon, Nicktoons and Universal Kids. Pre-2019 content makes up almost all of Discovery Family and Boomerang’s offerings.

When it comes to subscriptions, Disney+ is the only major streamer where kids’ content is the primary motivating factor for signing up. According to Ampere, 52% of family households in the US subscribe to Disney+ for the children’s content, compared to 30% for Discovery+ and YouTube Premium; 29% for Netflix; 24% for Apple TV+, Hulu and Paramount+; 20% for Amazon’s Prime Video; and 19% for Max and Peacock.

SVoD platforms and pay TV channels are “much less interested” in commissioning kids’ content, Black added, noting that the number of kids’ TV seasons ordered by the SVoDs in the US fell to 27 in the second half of 2023, from 49 in the first half of 2023 and 70 in the first half of 2022. At the US pay TV channels, the number fell to 10 in H2 2023 from 23 in H1 2023 and 54 in H1 2022.

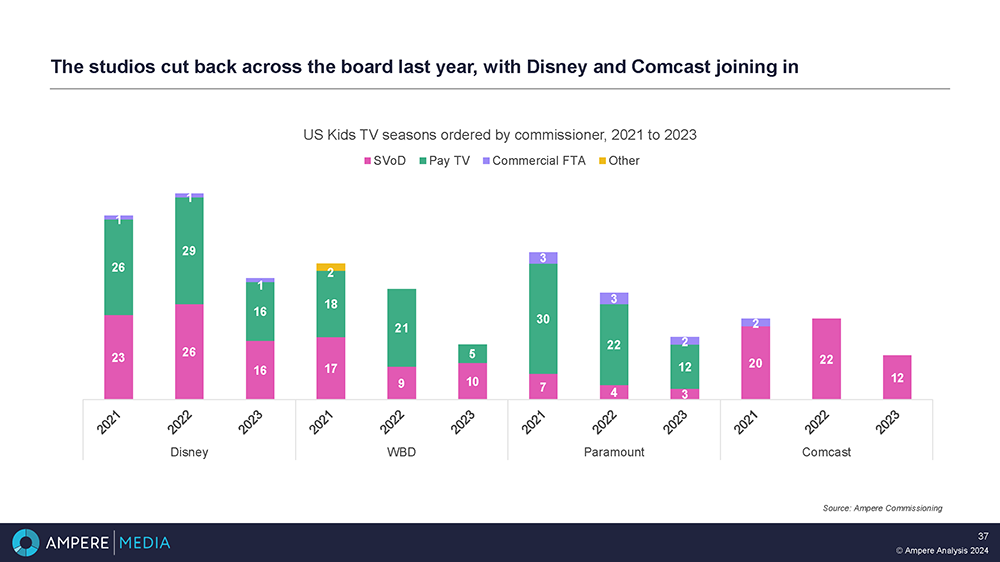

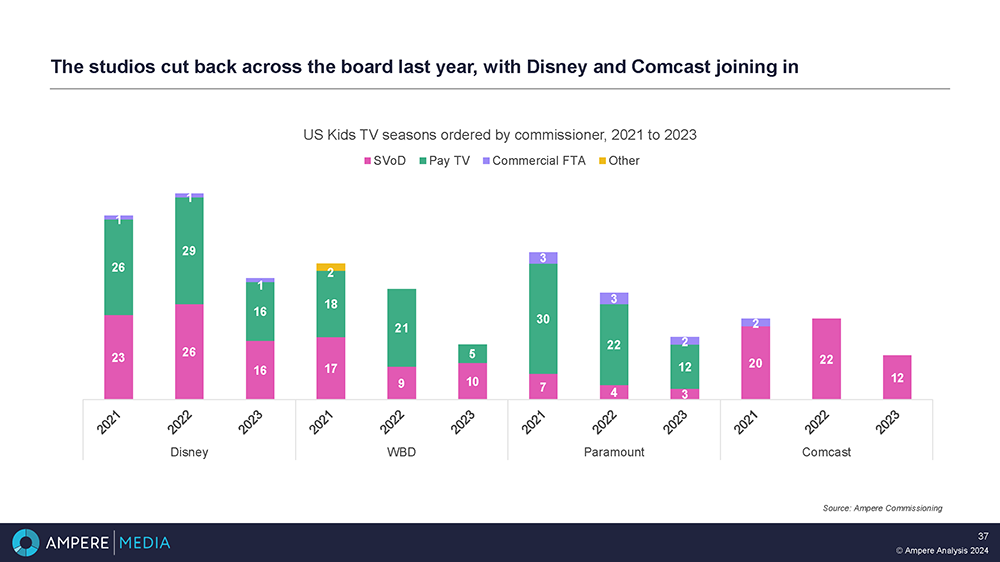

At the major studios, Warner Bros Discovery’s kids commissions halved in 2023 year-on-year, with Disney and Paramount’s commissions falling by 41% and Comcast posting a 45% decline. Outside of the studios, YouTube’s kids commissions plummeted by 75%, while Netflix and Apple’s fell by 40% and 22% respectively. Kids commissions at US pubcaster PBS remained flat in 2023, while Amazon’s grew by 100% since it hadn’t commissioned anything in 2022.

Comparing animation to live-action, the number of animated kids’ TV seasons ordered in the US in 2023 fell to 99 from 152 in 2022. Live-action experienced a decrease to 27 kids’ TV series ordered in 2023 from 49 in 2022, which Black said makes the medium “close to extinct.”

Meanwhile, an animated commission today is “almost certainly a renewal,” Black said. The number of first-run animated shows at Netflix in 2023 dropped to three from 17 in 2022, with Disney’s falling to 10 from 19, Warner Bros Discovery’s to four from 11, Paramount’s to one from five and Comcast’s to two from five.

When animated commissions in the US are for a new show, they are now most likely to be a spin-off from existing IP, Black added. In 2023, 21 new kids’ shows in the US were original ideas, versus 29 that were either reboots, remakes, spin-offs or adaptations.

While the major studios are reducing the number of commissions they make, they are “buying content like never before” to hold on to subscribers, Black said. In 2023, 1,557 acquired shows were added to studio-owned platforms and channels, versus 804 acquired shows in 2022.

Meanwhile, new IP is still being commissioned internationally, which Black said means “the path to success could be from outside to in.”

“SVoD services are beginning to struggle to add new subscribers. This is leading them to focus on increasing revenue of existing subscribers and reducing churn,” Black added.

“Kids’ content is not a draw for new subscribers but is proven to reduce churn. This is leading the streaming services to try to increase their kids’ content libraries, without commissioning it themselves or paying over the odds for exclusivity.

“In the US, that has created an almighty drop in commissions. The volume of content being produced has been heavily cut back and those titles that are still commissioned are predominantly renewals or are, at least, based on existing IP.

“However, internationally, the picture is different. Markets with well supported public broadcasters are able to continue commissioning new content at usual rates, with new IP still a focus.

“The US studios aren’t commissioning new kids’ content but are certainly still buying it. That creates an opportunity for distributors to place content with platforms and platform owners that can take a title worldwide, without having to sign away exclusivity.

“A downturn in global commissioning means less content in the marketplace. If you can find a commission or self-fund, the demand for content to fill libraries is still high and the potential for a title to become a hit is strong.”

.jpg)