There has been a sea-change in Japan’s international TV strategy in recent years, as exports and partnerships take centre stage. BEAJ chief Yukiko Kimishima talks us through the big trends and the organisation’s C21 Digital Screenings playlist.

For many years, Japan was – rightly or wrongly – perceived by the international TV industry as a closed market, hard to sell into and with only animé and extreme endurance formats coming out.

It’s something that Yukiko Kimishima, Chief Executive of Business Management of the Broadcast Programme Export Association of Japan (BEAJ), acknowledges: “Japanese programmes were in the past mainly produced with the Japanese audience in mind, so it was not often that Japanese dramas or variety shows became hits in foreign countries.”

But things have changed in recent years. Changed a lot. Japan has developed a much more outward-facing television industry, is working more with Western partners and has started creating and exporting shows that are geared towards international as well as domestic success.

Japan’s unscripted formats have expanded into new genres, such as dating, talent shows and reality, all backed by the now established Treasure Box marketing initiative from the main exporters. And on the scripted front, new opportunities with the global streamers are giving better exposure to Japanese content that simply wasn’t possible before.

“Streamers have generated new interest for Japanese animation in Europe, for example, where content quotas were restricting the amount of Japanese animé aired by free-to-air channels,” explains Kimishima. “It’s the same for Japanese drama, which has a truly global fan base but hasn’t yet been picked up by Western mainstream broadcasters.”

Demand for Japanese content is certainly on the increase. Though European demand is growing, as Kimishima says, the big markets for Japanese content are within Asia, especially Taiwan and China. “Since the subculture of Taiwan and China has been influenced by Japan, they have been big fans of Japanese animé and dramas,” says Kimishima. “Appetite for drama has been especially strong, with almost 75% of Japanese exports in this genre going to Asia. As for the popularity of animé, it is not only in Asia but also in Western countries.”

The global boom in local production has also increased demand for Japanese formats. “With respect to unscripted formats, the titles are fewer but such unscripted formats are highly visible and have enjoyed acclaim in Western countries,” explains Kimishima.

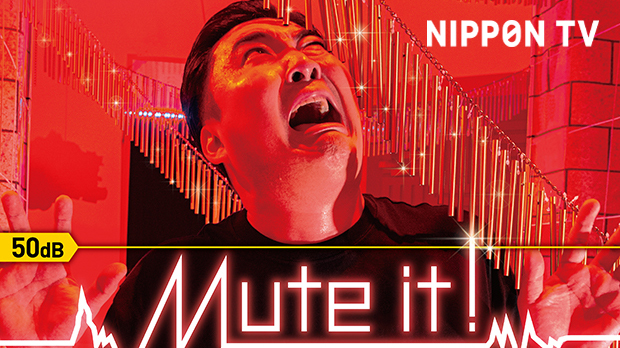

On top of pioneering and well-travelled IP like Fuji TV’s formats Hole in the Wall and Iron Chef, Nippon TV’s format Dragons’ Den and TBS hits Ninja Warrior and Takeshi’s Castle, newer formats are also winning deals. Time is Money – The Celebrity Life Hack Show from TBS, for example, has in recent months been picked up for international distribution by Sony Pictures Television.

Over at TV Asahi, format sales are making remarkable progress, according to Kimishima, led by hit show Ranking the Stars, which has been on air in the Netherlands for 17 seasons and with its German version premiering in 2020 during the pandemic. Other unscripted formats that have seen recent success include Quiz Pinch Hitter, which Fuji TV is launching at the digital version of Hong Kong Film Market next month.

Japan’s recent success with scripted formats includes a unique deal that saw Fuji TV’s drama format The Confidence Man JP produced for Japan, China and South Korea simultaneously. Nippon TV’s drama Mother, furthermore, has seen remakes all around the globe, including in Turkey, South Korea, Ukraine, China and Thailand.

“The ‘golden age’ of drama has generated stronger interest in Japanese scripted formats,” adds Kimishima. “Japanese success with scripted formats started in Turkey, which then became the base to export them further worldwide. Turkey plays a special role, as its version of Mother has been a hit in Latin America and Spain, which will even lead to a remake in France and elsewhere.”

The increased volume and diversity of Japan’s content exports in recent years, Kimishima largely puts down to the impact the global streamers have had, not just on the global visibility and awareness of J-content but also the kind of shows that are now being produced in Japan.

“More TV producers and directors who have been involved in the domestic TV industry have become conscious of the international market, since they are also stimulated by SVoD foreign dramas and other content. I hope these content exchanges raise not only the quality of content itself but also the capacity to understand the respective cultures from where they originated,” she says.

Examples of this globalisation of Japanese content include Netflix productions The Naked Director, Hibana: Spark, Samurai Gourmet, Alice in Borderland – “all very Japanese shows but with an international look and feel,” says Kimishima. She adds that 2020’s comic book adaptation Alice in Borderland was so well-received that it managed to rank on Netflix’s Top 10 lists in more than 50 countries.

Japanese dramas that are greenlit for streaming are also becoming more edgy in the hope of reaching younger demographics. Edgy dramas for the Fuji Television on Demand service, for example, include (Un)Satisifed, I Bought My Boyfriend on a Loan, Pornographer, Blue & I, Cupid’s App and Tokyo Love Story 2020.

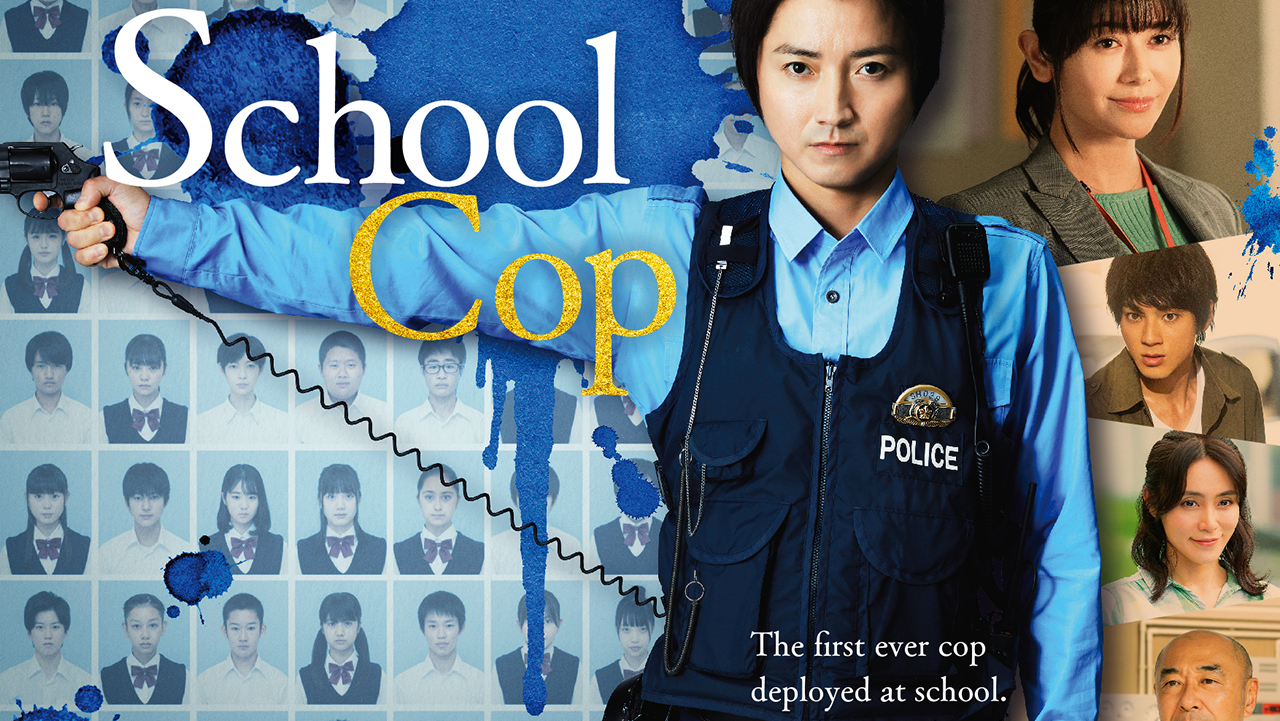

Other new Japanese dramas to keep an eye on include This Guy is the Biggest Mistake in My Life (ABC), School Cop (Kansai TV), MIU 404 (TBS), Harassment Games (TV Tokyo) and The Sun Stands Still (Wowow).

“As for animé, due to strong investment, animé production companies are now able to find other ways to directly expose their content worldwide, which has not traditionally been the norm with TV animé,” Kimishima adds. These factors have contributed to Japanese animation sales remaining largely unaffected by the pandemic of last year, according to data from TBS and TV Asahi, with the latter company doing particularly well with new series Super Shiro.

This global-facing strategy has also seen Japanese networks embracing coproduction more. The free-to-air channels are now regularly coproducing with Netflix, with shows such as Million Yen Women and Kantaro: The Sweet Tooth Salary Man coproduced with TV Tokyo and Atelier with Fuji TV. Other examples are Miss Sherlock and The Head, both coproduced by Hulu Japan and HBO Asia, and The Window, a drama being coproduced by Fuji TV and ZDF Enterprises in Germany.

“The Japanese government has been supporting coproductions involving broadcast programmes between Japan and overseas countries since 2014. So far, more than 300 projects have been supported, mainly in Southeast and East Asia, but there is no geographical limitation,” explains Kimishima.

Further evidence of Japanese broadcasters’ willingness to coproduce can be seen in the field of unscripted formats. A growing number are teaming up with production companies in the West to co-develop formats that feel uniquely Japanese while appealing to non-Japanese audiences.

Examples include unscripted formats 9 Windows, co-developed with Nippon TV and UK-based The Story Lab, and Block Out, which Nippon TV developed with Red Arrow Studios of Germany. NBCUniversal and Asahi Television Broadcasting also agreed a partnership to jointly develop new formats last year, as have The Story Lab and Fuji TV. The TBS format Time is Money, it’s also worth noting, was developed for the international market under the broadcaster’s alliance with UK-based Little Delicious Media.

It’s not just the commercial networks that are working more with Western companies: pubcaster NHK has teamed with Netherlands-based distributor Lineup Industries to drive the international exploitation of its formats, including The Late Night Show with Nitty & Gritty, 72 Hours and Chiko’s Challenge.

Against this backdrop of Japan’s increased global outreach, BEAJ has selected a number of new shows to showcase in its C21 Digital Screenings suite this week, in the hope of generating the next wave of J-content hits. Given the unique culture of the country, it’s no surprise that food and travel titles are high on the list.

The playlist includes travel shows Love Hokkaido (260×24’) from Hokkaido Television Broadcasting, ongoing series 100 Sights of Ancient Cities (68×24’) from Nihonkai Telecasting, and Yamatoho (36×18’), a series that mixes comedy and hiking from Fukuoka Broadcasting System.

Two more travel shows come from San-In Chuo Television Brordcasting: Wa! Journey! Discover Japan Pride (6×30’) and Wa! Journey! Wonderful Japanese Culture (6×23’), while European TV hosts Paddy Doherty and Daniel Coll front Dan & Paddy’s Bucket List – Kyushu, Japan (10×24) from RKB Mainichi Broadcasting.

Travel mixes with food in Traveling Chef De France in Hokkaido (8×25’), fronted by French chef Amandine Chaignot, from Hokkaido Broadcasting, and the food theme continues with Restaurant Revival ¬– Memory of Taste (1×50’) from Hiroshima Television Corporation. Ramen Kingdom (2×46’/1×45’), meanwhile, is a look at the art of ramen cooking from Yamagata Television System.

For documentary buyers, the playlist includes Shizuoka Asahi Television’s look into bluefin tuna fishing, Pursue The Finest Tuna! (1×51’), while Nishikigoi (1×30’) is a documentary about Koi farmers from Television Niigata Network. More cultural excursions can be found in Yamagata Craft Story (1×52’), an enlightening hour from Yamagata Broadcasting.

For buyers looking for sport-related factual there’s Try Time in Kyushu Japan! (2×30’), a look at the 2019 Rugby World Cup in Japan from Oita Asahi Broadcasting. The show features Justin Marshall and Nathan Sharpe, who played in national rugby teams of Australia and New Zealand. No Matter Board, meanwhile, is a 20×23’ series about snowboarding from Hokkaido Television Broadcasting.

The playlist reflects another big trend in Japanese TV. While the biggest exporters are still the main Japanese broadcasters, local stations are increasingly joining them in selling their content outside of Japan and looking for international coproduction opportunities. Unlike the major players, which are involved in most genres of programmes, local stations tend to focus mostly on factual programming such as the travel and food shows above.

Members of the Broadcast Program Export Association of Japan explore the trends behind the growth in international demand for Japanese content as they showcase their latest programmes via C21’s Digital Screenings portal.

Exports of Japanese broadcast content are on the up, according to data from the country’s Ministry of Internal Affairs & Communications. Figures for the full year 2021 show that total exports stood at approximately Y65.56bn (US$445m), an increase of 15% on the previous year, and the number of broadcast programmes licensed overseas was 3,824 for that year, up 8% on 2020.

Breaking down the data further, we can see that US$86.5m was generated by the sale of broadcasting rights, US$156m by internet distribution rights, US$11m by format rights and US$181m by licensing and merchandising rights, mainly for Japan’s hugely popular animé series that account for the lion’s share of the country’s content exports.

READ MORE

Yukiko Kimishima, chief executive of business management at the Broadcast Programme Export Association of Japan (BEAJ), discusses how streaming has impact the country’s content exports and which genres are travelling the most.

What data can you share regarding the growth in Japanese content exports in the past year?

According to a report compiled by the Ministry of Internal Affairs and Communications, based on its annual survey of broadcasters and other organisations, the total value of content exports to foreign countries increased by ¥4.61bn [US$35.4m] during the one-year period from 2019 to 2020. This represents a 9% increase over the previous year. Within this figure, while the export value of programme broadcasting rights decreased by ¥610m, that for online streaming rights increased by ¥3.19bn, contributing to the growth in overall export value.

READ MORE

Yukiko Kimishima from the Broadcast Programme Export Association of Japan reveals how demand for Japanese content soared during 2021 and looks at the year ahead, while also showcasing a new slate of Japanese programming.

2021 was a banner year for the export of Japanese television programming. The ongoing streaming revolution, thanks in part to all the lockdowns worldwide, was a major factor driving this trend, says Yukiko Kimishima, chief executive of business management at the Broadcast Programme Export Association of Japan (BEAJ).

READ MORE