Theme Festival - TV Movies

The international market for telemovies has seen a spike due to the growth of SVoD and the Covid-19 pandemic, executives from the sector tell Karolina Kaminska.

Movies made for TV have traditionally always had their own place in the TV and film world, with specific homes on dedicated channels or during certain slots in broadcasters’ schedules.

But as the content industry evolves and more platforms for watching TV emerge, particularly with respect to the influx of streaming services, telemovies are finding new homes while the lines between them and films intended for theatrical release are becoming increasingly blurred.

According to Hannah Pillemer, head of content at MarVista Entertainment, the LA-based producer-distributor has seen a “huge” increase in demand for TV movies in recent years, which has been accelerated by the Covid-19 pandemic this year.

“The reason for that is the change in our viewing habits, with the streaming platforms that are now there and need a ton of content all the time to feed people’s appetites,” Pillemer says.

“Then, with the pandemic, it’s just gone through the roof, now people are at home. We’re especially seeing this for the holiday season this year – there is this anticipation that people are going to be so hungry for feel-good content while stuck in their houses. So, that’s creating a kind of perfect storm, which is great for those of us who supply this content, because it’s a big opportunity.”

While the TV movie may have faced competition recently from longer drama series that have been so in-demand among broadcasters, Pillemer adds that this trend is beginning to reverse as viewers, especially during the pandemic, seek shorter, more light-hearted content.

“We went through this cycle where there was so much longform anthology content, but after a certain point it gets fatiguing when you see you’ve got 40 episodes of a show you have to get through. So, we’ve seen our partners and buyers wanting more of that feature-length content,” she says.

“We were already seeing this trend and now, with people stuck at home, they don’t always want to watch something really heavy or invest in something that’s really intense over 40 hours of viewing. They just want to watch a quick piece of content that they can enjoy and then move on with their lives.”

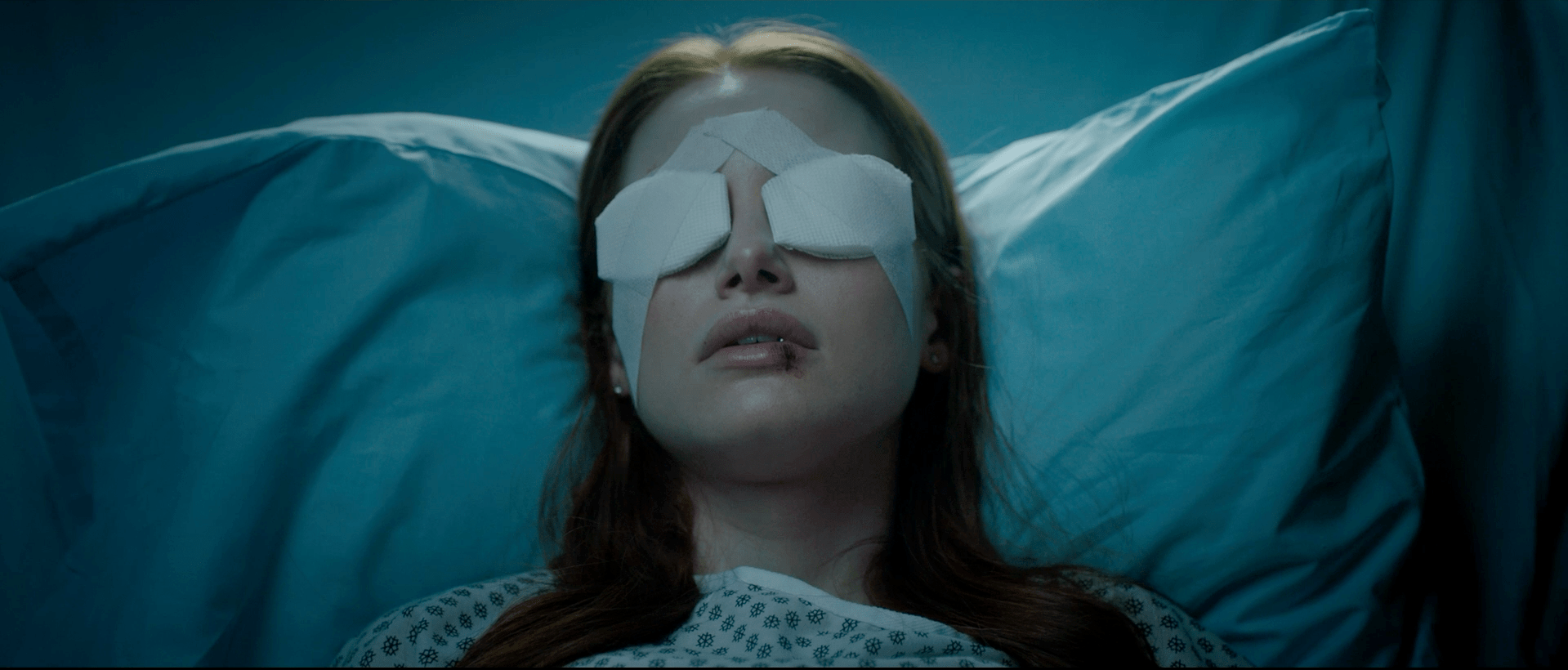

MarVista is behind a wealth of Christmas TV movies, including upcoming features Midnight at the Magnolia and Christmas Ever After, as well as Lifetime’s Secrets franchise of crime drama films and forthcoming thriller Sightless, which was recently released on iTunes and Google Play and will hit Netflix worldwide in the new year.

Meanwhile, Joel Denton, acting president at Red Arrow Studios International, says the distributor has seen increased demand for telemovies in recent weeks, but that earlier in the pandemic ad-supported broadcasters had cut down on acquisitions as they were hit by plummeting ad revenues.

“The automatic reaction from certainly a lot of the larger commercial broadcasters was to cut back on acquisitions and commissions in favour of re-running older shows. So, there has been a slowing down generally in acquisition terms from them. Heading into the last quarter after the summer, it feels like it’s changing and there’s a bit more of an appetite for acquisitions. We’ve been seeing a pick-up in acquisitions of TV movies over the past few weeks, which we expect to continue through the rest of the year. But who knows? Things change very quickly,” Denton says.

“In pay TV terms, there has been much less impact from coronavirus because most of their income comes from subscriptions. So, with regards to companies like Sky and NBCUniversal and those sorts of networks that buy TV movies from us, we have seen very little change in demand there.”

According to Denton, a major change for the telemovie genre in recent years has been a move from primetime to daytime slots in broadcasters’ schedules, as local productions have taken over primetime.

“The biggest change over the past few years has been the move of TV movies out of primetime slots. This happened quite a few years ago, but TV movies used to occupy primetime slots on the larger commercial networks, such as RTL in Germany, TF1 in France, Mediaset and Rai in Italy and so on, before the rise of home-grown productions and formats shoved TV movies out of primetime and into daytime,” he says.

“They’re also bought in packages rather than individual titles because those broadcasters tend to aggregate them into strands, so they’re not necessarily promoting each individual TV movie but rather the overall slot itself.

“A lot of the movies we’re selling come from primetime in their home territory, for example, US TV movies on Lifetime and Hallmark air in primetime and then go on to have another life in the rest of the world in daytime slots.”

This move into daytime also means TV movies face little competition from drama series, Denton adds, as the latter take primetime slots and don’t tend to air during the day.

Which slots telemovies are selected for may be becoming less relevant to the genre now anyway, given the rise in on-demand, schedule-free viewing and as more and more streamers jump on the original film bandwagon.

Made-for-TV movies from streaming platforms like Netflix and Amazon Prime Video had already begun to blur the lines between telemovies and theatrical releases, as the big-budget streamers can afford Hollywood talent to star in and produce their original films.

This blurring of the lines has continued since Covid-19 caused many of the major US studios, such as Disney, to cut out the cinema window and premiere their latest films on their own streaming platforms.

“I was on a platform recently and was trying to tell the difference between the films that were theatrical and films that were made for TV. You can’t really tell anymore,” says MarVista’s Pillemer.

“There’s a question around whether we will be able to go back to the theatrical viewing experience and how that’s going to change. There’s definitely going to be a push to reduce budgets where possible in the feature space, because when you look at Netflix’s model it has movies that are shot for a fraction of what some of its bigger budget movies are.

“It feels like people are going to up their game. Having huge-budget movies next to much smaller, more contained movies is going to hopefully get all the creative talent to step it up so they can play on that same level.”

Red Arrow’s Denton adds: “Netflix has had traditionally quite a lot of success with romcoms as a TV movie genre and that seems to be quite important to the company. There’s obviously a good audience there for those movies on Netflix – it’s difficult to find the data to support that, but it’s commissioning and buying them, so we’re pretty sure that’s the case, and I can see that growing.

“We’ve got a slow and growing business supplying TV movies to SVoD platforms around the world. There’s definitely a blurring of the lines of what is a TV movie and what is a theatrical movie. It feels like movies are becoming a more important part of streamers’ broader mix and offerings.”

Conversely, Lise Romanoff, MD and CEO at LA-based distributor Vision Films, argues that TV movies and theatrical films play two separate roles in the movie space.

“Each channel programmes its blockbusters on a certain night at a certain time and programmes its telemovies at a certain time. They’re two different animals and there’s a good place for both of them,” she says.

Among Vision Films’ current TV movie catalogue are 2020 holiday movies Saving Santaland and Christmas With a Crown, in addition to thriller SOS and family adventure film Sky Dog.

As well as distributing to US channels like Lifetime and Hallmark, which traditionally buy a lot of telemovies, Vision Films’ other big buyers include M-Net in South Africa, Sky in the UK, Fox in Asia and some of the major broadcasters in France, Spain and Italy.

According to Red Arrow’s Denton, France is one of the strongest markets for buying TV movies, while there is less appetite from countries like the UK.

“France remains really important. We have a deal with M6 where they buy telemovies from us and TF1 buys a lot of TV movies as well. France is probably one of if not the best TV movie market out there at the moment,” he says.

“In Italy, we’ve sold packages to Sky, Rai and Mediaset over the years, so again it’s a good TV movie market, although Italian acquisitions have been slower over the last couple of years as the economy suffered a little bit. Spain is a very good market as well; TVE traditionally buys TV movies and so do Atresmedia and Telecinco.

“In the UK, there is less of an appetite. Channel 5 plays them usually in the later afternoon slot, while Sky has an appetite for some, particularly around Christmas.

“In Germany, TV movies were a kind of mainstay of the primetime schedules on the big networks, but that ended as we had that change-over to daytime. In recent years, we have begun to see more of an appetite for acquisitions, which is great because for a long time there was very little appetite. So, we’re now seeing ProSieben buy some of these for pay and free TV, while ARD has bought some in the past and ZDF as well.”

Red Arrow has a package of 18 new TV movies available for Mipcom this year, spanning romantic comedies, holiday movies and crime thrillers, commissioned by North American and European broadcasters. Titles include Wedding Every Weekend, produced by Weekend Road Productions for Hallmark, and Love’s Second Chance, produced by ReelOne Entertainment for M6.

Denton says he’s optimistic about the future of the TV movie, both thanks to the emergence of the streamers and with regards to traditional broadcasters.

“TV movies will follow along with the rise of streaming and where the streamers go. Smartly packaged TV movies can do really well for those streamers because they have a very specific audience with a very specific demographic. And it’s not too demanding – you’re watching a 90-minute soft, gentle, easy viewing film usually – and, at the moment, and probably for the next year or so, that’s going to be somewhat in demand at least,” he says.

“With the commercial broadcasters, it will depend on how much emphasis they put on their daytime schedules. That probably depends a little bit on ad revenue, but I see a good future. It’s a relatively healthy market at the moment. The movies still work with the audience, so I’d expect the genre to do pretty well.”