Studio shake-up: How Bob Iger's return will affect Disney's content strategy

In the first of a series of articles from UK-based analyst firm 3Vision, director Jack Thomas explores how Bob Iger’s return to the CEO position at Disney will affect the US studio’s content strategy.

At the end of last year, Disney announced it was swapping one Bob for another as CEO, with Bob Chapek out to make room for Bob Iger re-emerging from a short retirement.

Disney+ as an SVoD service has yet to post a profit for the company despite a huge surge in subscribers since its launch and a mass roll-out to most major markets, with some of its more recent expansions, such as South Africa and Poland, inevitably bringing the average revenue per global user down.

This is an issue to be expected of any new service requiring investment in originals, with profitably not expected until 2024.

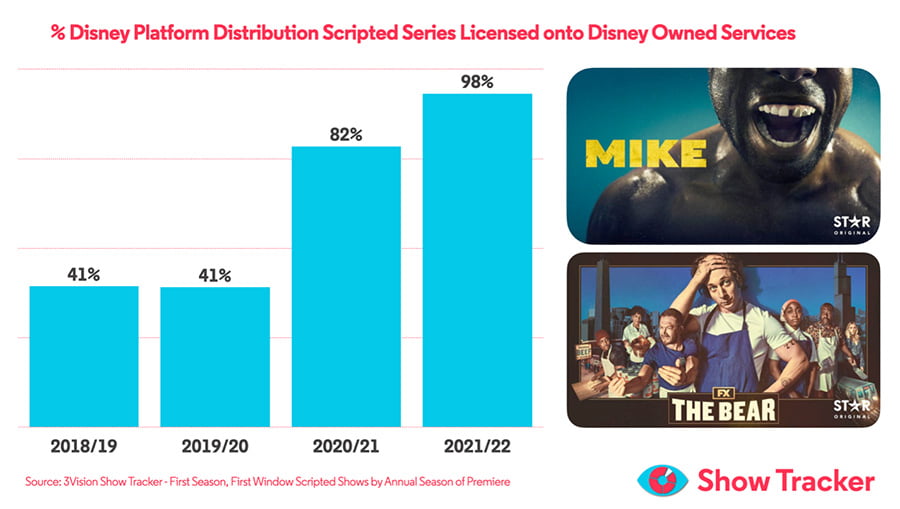

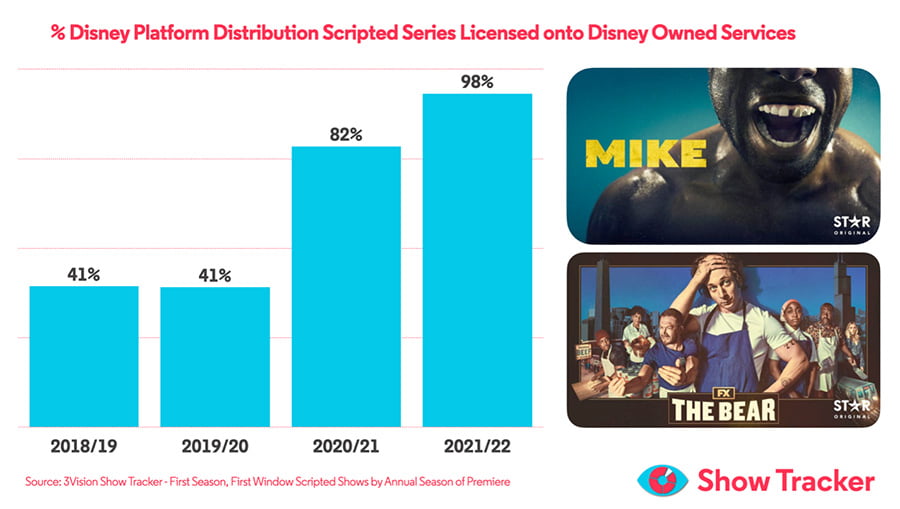

The issue for Disney is that its commitment to the platform denies it a once reliable revenue stream borne from its international content deals. Since the launch of Disney+ and its Star add-on in international markets, the amount of Disney content being licensed directly to Disney-owned services, rather than third parties, has risen rapidly.

Despite this increase in content, Disney is still acquiring some titles from third-party distributors for its services in international markets, including their linear channels, where these are still active.

Despite this increase in content, Disney is still acquiring some titles from third-party distributors for its services in international markets, including their linear channels, where these are still active.

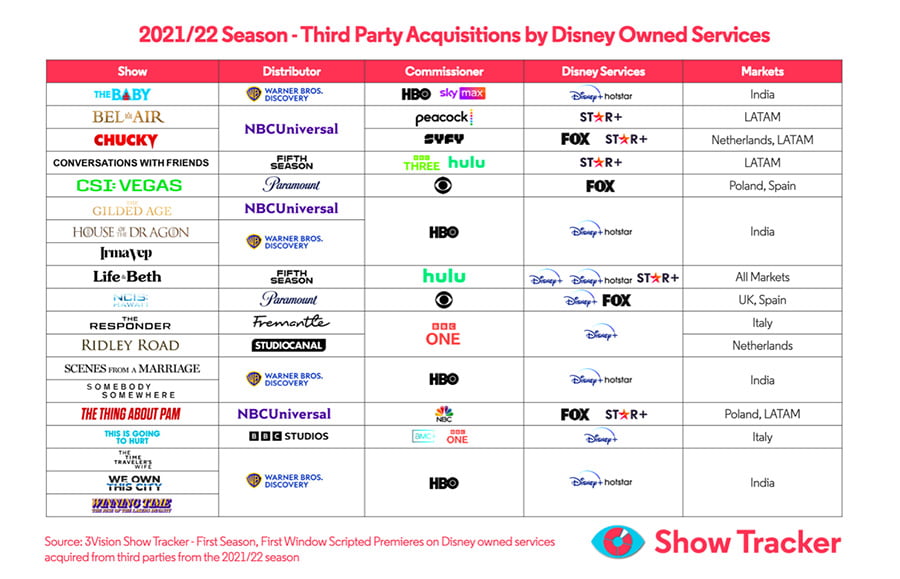

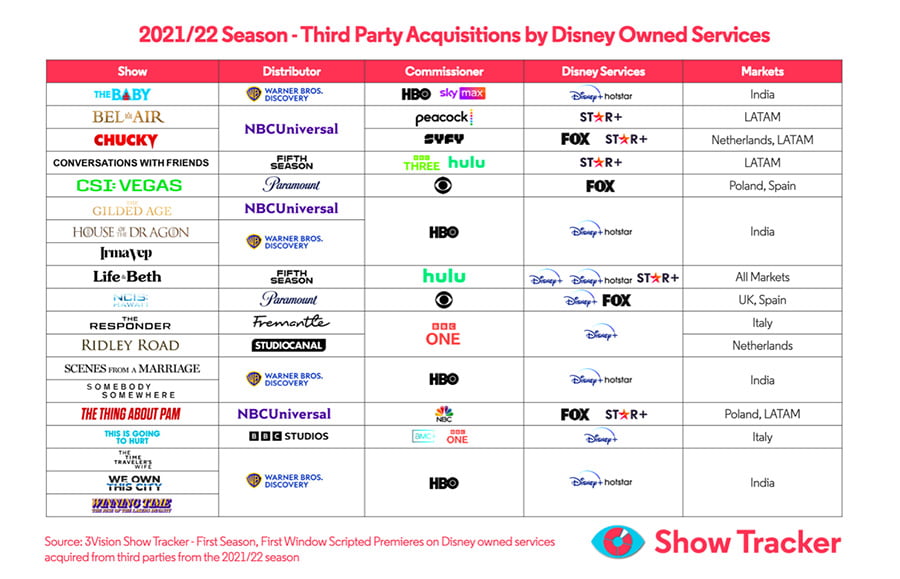

India’s Disney+ Hotstar is responsible for the most third-party premieres and continues to benefit from a volume deal with Warner Bros Discovery for HBO Originals. This deal was signed before Disney’s acquisition of 20th Century Fox (which included Star India).

In Latin America, Star+ is sold as a separate subscription to Disney+ and is taking a number of series from NBCUniversal (NBCU), while in Europe, UK content from the likes of BBC Studios, Fremantle and StudioCanal is premiering on Disney+ in Italy and the Netherlands.

While some of this activity shows an opportunistic approach to supplementing the Disney+ catalogue with high-profile acquisitions, these types of premiere have been, in fact, decreasing. This downward trend will likely continue as content licence fees add a further strain on top of Disney’s huge gap in distribution revenue.

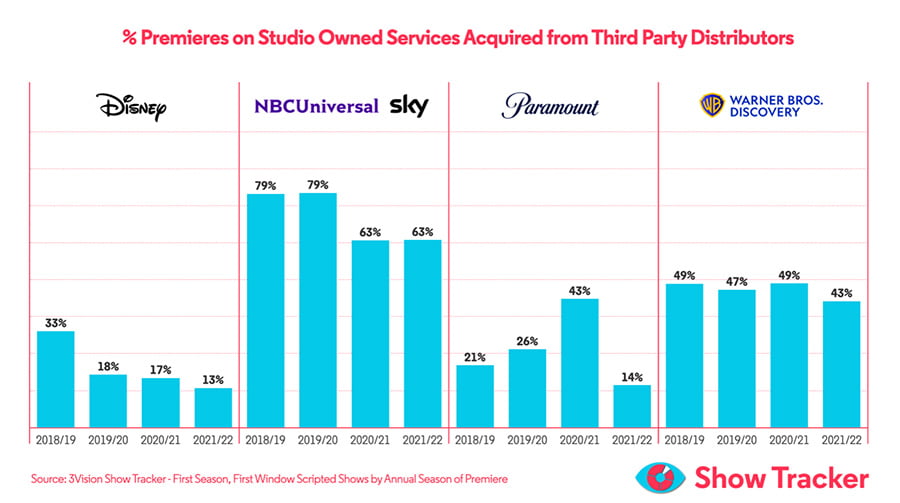

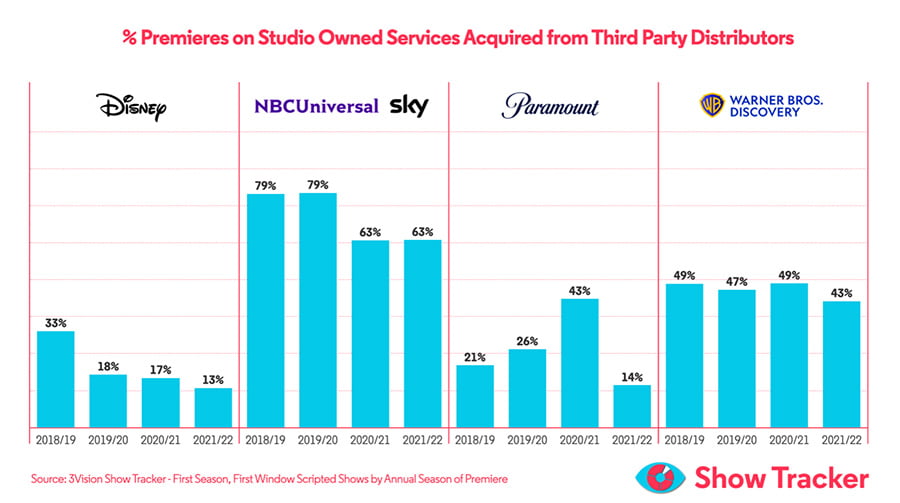

This trend seen by Disney is similar to other US studios’ third-party acquisition activity, although on a different scale. NBCU’s presence in EMEA in the form of major pay TV operator Sky has resulted in historic highs in the proportion of its content acquired, with its more recent reduction in third-party acquisitions caused not by NBCU but its pivot from historically reliable suppliers like Paramount and Warner.

Paramount, meanwhile, has engaged with fewer third parties over the years as it pours more of its own content on to Paramount+, with the exception of the 2020/21 season, which saw a large reduction in Paramount commissions due to Covid production delays.

Recently merged Warner Bros Discovery has kept a relatively stable engagement with third-party suppliers, with HBO Europe acquiring a large amount of US and UK content in multi-market deals.

Disney’s multi-market third-party acquisition activity has been much more limited, namely its Hulu commissions in the US with external distributors such as The Hardy Boys from Nelvana.

Disney’s multi-market third-party acquisition activity has been much more limited, namely its Hulu commissions in the US with external distributors such as The Hardy Boys from Nelvana.

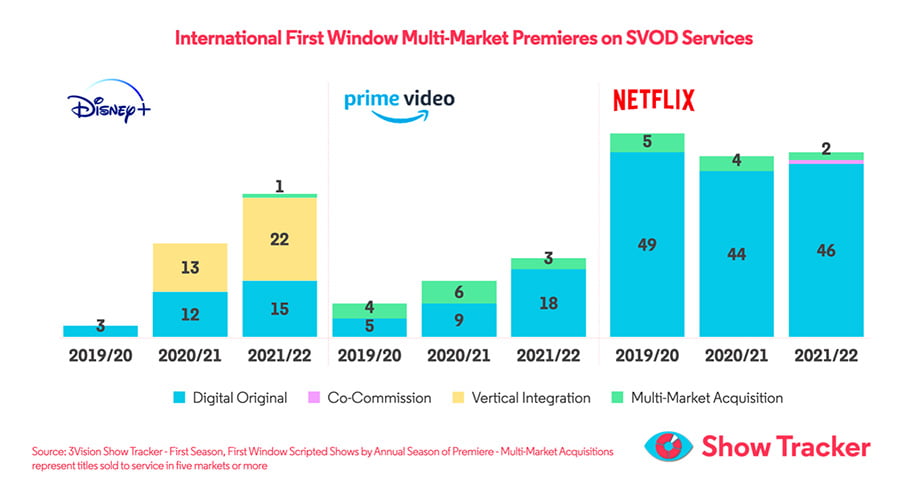

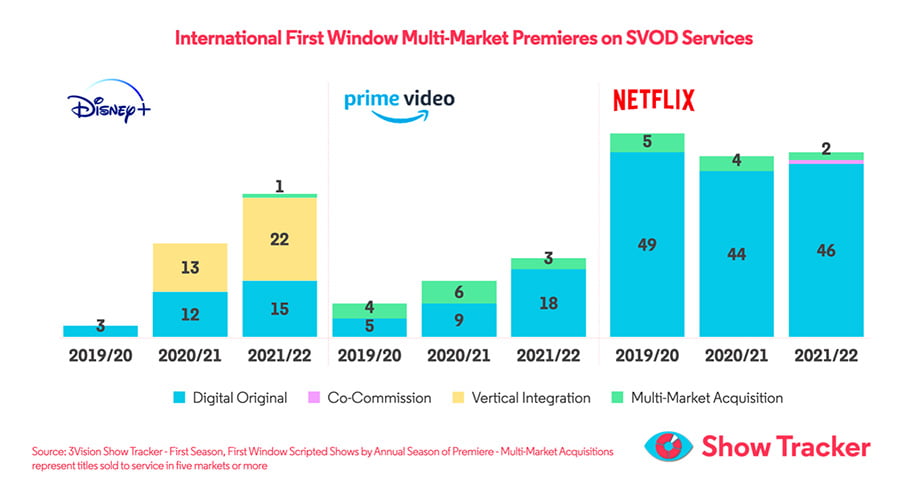

Internationally, the level of original Disney+ content is greatly improved by its vertical integration pipeline, with the service typically being the first-window international home to originals from Hulu, ABC, FX and Freeform.

With Netflix set to cut down on the number of new originals it produces annually due to the company’s issues with user growth, Disney may now be able to reduce its prolific investment in new series.

Within the US, Disney+ is heavily reliant on its own originals as other Disney-owned services like Hulu, FX and ABC need to retain some level of exclusivity on their commissions. However, outside of the US, vertical integration has enabled Disney to premiere all of its titles on just one service, helping grow the total scripted output of Disney+ well past Amazon’s and now to a competitive level with Netflix’s originals pipeline.

The US remains a pivotal market for Disney+, but the studio’s continued investment in commissions for its other channels is enough to potentially take Disney+ ahead of Netflix in 2023 in international markets.

Its scripted content volume is a landmark achievement not just to praise at the next quarterly results call, but also an excellent explanation for any planned rise in the price of a subscription. A restrained and thoughtful level of content investment may be all that is needed to keep the SVoD’s course on its path to head of the SVoD pack, without breaking the banks to continue funding a content arms race.