Scripted surges ahead

Posted By C21 Reporters On 28-04-2015 @ 5:00 pm In News | Comments Disabled

C21’s new series of articles examining the international formats business suggests scripted properties continue to command the most interest, while regional formats are also blossoming.

Gogglebox

In this fifth year of the C21 Formats Report we see a change blowing through the business, with scripted formats continuing their rise at the expense of other kinds of format.

The drama boom may have shifted the focus away from reality and gameshows over the past year but it has certainly boosted demand for scripted formats as buyers the world over seek local content and see formats as a way of reducing development time.

This annual report, produced in association with MipFormats and sponsored by Nordic World, mixes headline narrative from C21’s ongoing Schedule Watch strand with our yearly C21 Formats Survey to take the temperature of the formats business, highlighting threats and opportunities. This year we have profiled 35 channels from 16 countries to determine their formats strategy and received responses from 132 executives throughout the survey.

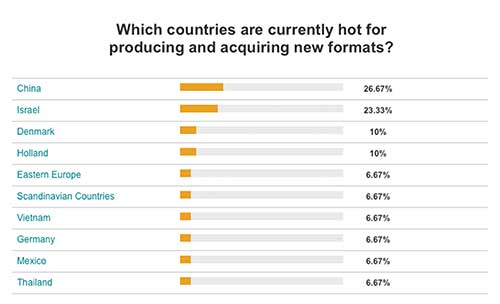

The results of both pillars of the report show that while there is confidence format sales will hold up this year, business is becoming more regionally focused, with Asia commanding an increasingly strong position in the formats sector.

The verdict from MipFormats over the pre-MipTV weekend in April was that Asian companies look poised to inherit the format industry, judging by the sheer marketing presence of big companies from Japan, China and Korea. The opening-night party for both MipFormats and MipDoc, for instance, was sponsored by China’s JiangSu Broadcasting, which had a slate of new formats to offer buyers, while Japanese broadcasters under the Treasure Box banner made their presence felt with sushi buffets to promote their own slates of original formats.

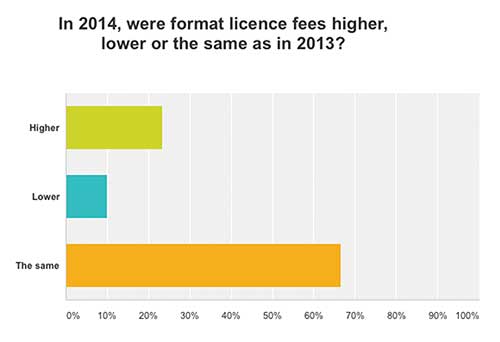

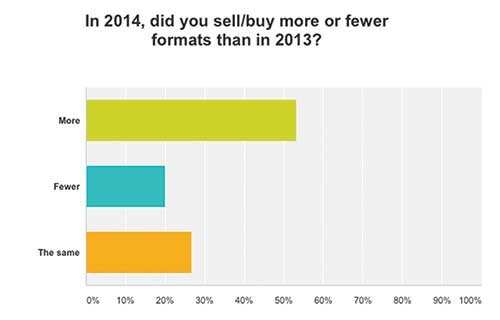

Of those surveyed for the C21 Formats Report, some 90% of respondents said format licence fees last year were either higher or the same as those in 2013, and more than half of respondents said 2014 was better in terms of the number of formats licensed compared to 2013.

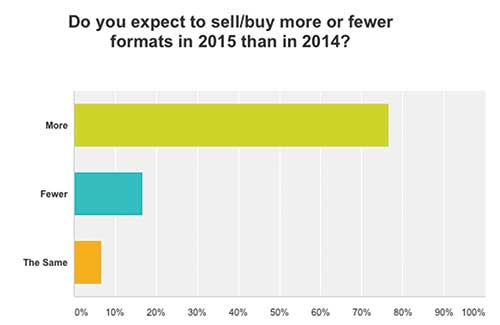

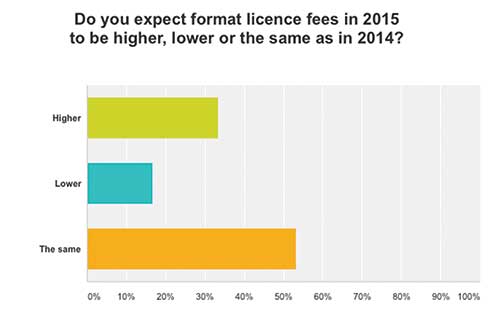

Regarding expectations for this year, more than 85% of respondents said they expect licence fees for 2015 to be at least the same of higher than those for 2014. Furthermore, more than 75% said they expected to buy or sell an equal or greater number of formats this year compared with 2014, all of which reflects confidence in the buoyancy of the market for TV intellectual property.

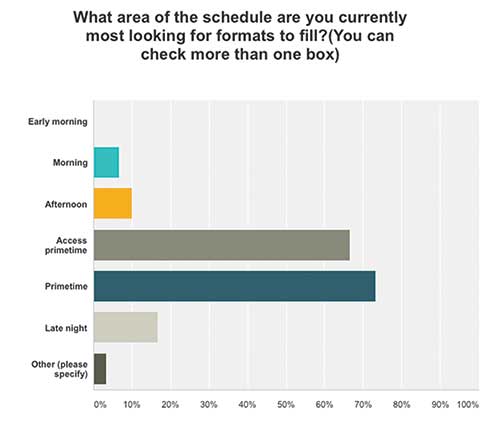

As far as areas of the schedule that buyers are looking to fill with formats, respondents said access primetime (66% of respondents) and primetime (73%) were still the main markets for formatted programming. This compared to 16% for late-night, 10% for afternoon and 10% for other time periods.

Our survey also sought to find out which international markets are buying the most formats and which are supplying the hottest new ideas. By a long chalk, China and Israel were mentioned by most respondents, with Denmark and Holland in third and fourth place.

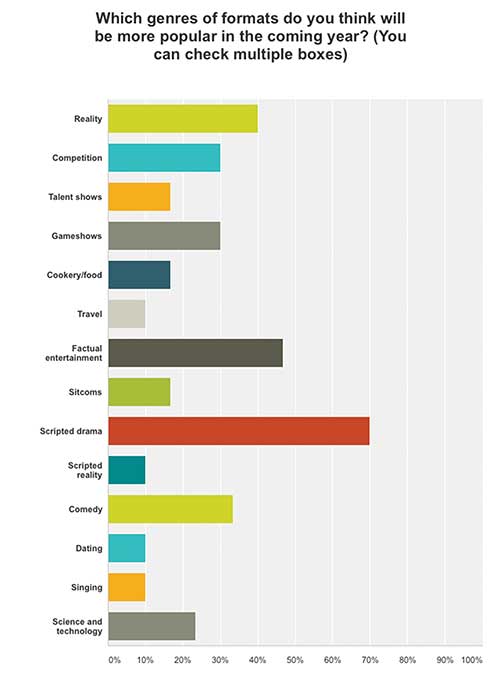

Breaking things down into genre, scripted drama formats were considered to be the most popular genre going forwards, with factual entertainment and reality also getting mentioned by respondents.

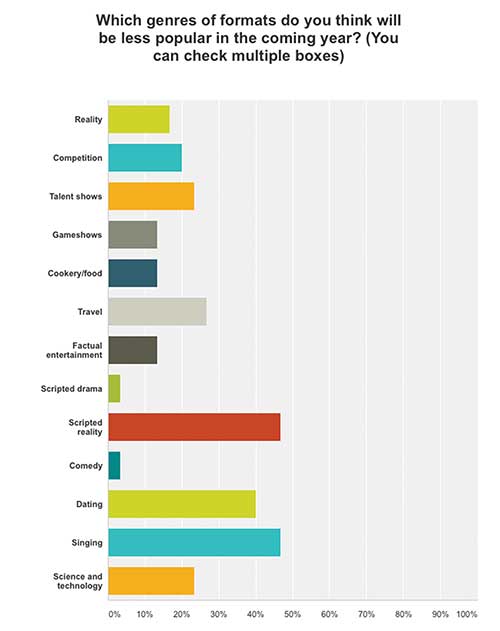

Genres predicted to be less popular in the coming year included scripted reality, perhaps reflecting the move towards authentic factual among a number of channels at MipTV 2015. Dating shows and singing formats were also said by respondents to be less in demand on the global market. Gameshows, scripted and multi-platform formats were considered to be the most underserved genres, perhaps reflecting a return to good old fashioned game formats, that the drama boom still has room to grow and the quest for good interactivity continues.

There are also fewer stand-out shows, with just one – Gogglebox – named by more than 25% of survey respondents as a programme that caught their imagination in the past 12 months. This would suggest there is a lack of real creativity and risk-taking making it through the development and commissioning process.

Beyond this, there is yet to be a real break-out hit on the multi-platform front, and while there are many new shows on offer, it would seem the formats sector needs a new hero in 2015/16. We also asked respondents about what they thought were the biggest threats to the format business. That old favourite, intellectual property theft, and the increasing number of derivative formats were top of the list.

Broadcasters profiled in this report include: ABC1, Fox8, Seven Network and Network Ten in Australia; ATV in Austria; TV2 and TV2 Zulu in Denmark; France 4, M6 and TF1 in France; ARD Das Erste, RTL, Sat.1 and ZDF in Germany; and Antenna in Greece.

The list also includes: Big Magic in India; Ireland’s RTÉ1; Italian channels Canale 5, Rai Uno, Rai Due and Sky Uno; NPO1 of the Netherlands; TVNorge in Norway; Antena 1 in Romania; Spain’s Antena 3, Telecinco and TVE La 1; SVT1 and TV4 in Sweden; TV1 in Tanzania; and UK channels BBC1, Channel 4, Channel 5, ITV1 and Sky1.

Look out for daily profiles of the format acquisition activities and requirements of these 35 channels coming to the PRO section of C21media.net over the coming weeks.

Article printed from C21Media: https://www.c21media.net

URL to article: https://www.c21media.net/news/scripted-surges-ahead/

URLs in this post:

[1] Image: https://cdn.c21media.net/wp-content/uploads/2015/04/area-of-schedule.jpg

Click here to print.