GetGlue sticks with social TV

GetGlue has revamped its entertainment ‘check-in’ app to become a social media-driven next-generation TV discovery service, but it’s up against increasing competition, writes Jonathan Webdale.

Alex Iskold

GetGlue was among the first Foursquare-style apps that sprang up a couple of years ago, taking the notion of a location-based check-in service and applying it to entertainment.

It arrived on the scene in the summer of 2010, born out of New York-based start-up AdaptiveBlue, whose roots in semantic web browsing go back several years earlier but now focus solely on GetGlue.

The firm has been through four rounds of funding – two under its present guise, both involving Time Warner, with the most recent a US$12m chunk that came at the start of this year.

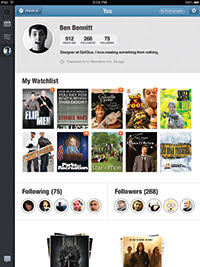

GetGlue initially offered users the ability to ‘check-in’ with whatever entertainment experience they happened to be having, to share the fact they were listening to a particular piece of music or watching a certain TV show with friends via social networks or strangers with similar tastes, drawn together through the app itself.

The company hooked up with partners across a wide variety of sectors to offer promotions so that users were being rewarded with more than just ‘virtual badges’ in return for their efforts. In the TV space this meant viewers who checked in to shows such as House, The Simpsons or Jersey Shore received discounts on related merchandise.

Earlier this year, GetGlue shifted its emphasis, focusing on TV and film, perhaps as a result of HBO, Turner Broadcasting and Warner Bros parent Time Warner’s increased interest.

At the same time in introduced a new version of its app – one specifically designed for the Apple iPad, a device that arguably gave birth to the concept of the second screen.

The GetGlue redesign incorporated a subtle shift away from audience check-ins and a move towards becoming more of a social TV guide – a listings service that suggests what you should watch based on your past viewing, preferences and what’s trending among your friends, rather than what’s on the schedules. Not only does it highlight what’s on television but TV shows and movies on Netflix, Apple iTunes and Amazon as well.

GetGlue

“This release broadens what we offer and recycles the data we’ve received over the last two years back into the community to power up the next generation of discovery around TV,” says GetGlue founder and CEO Alex Iskold.

“Current guides are very cumbersome and impersonal; they’re complex grids with thousands of choices and it’s really hard to find what to watch. This one is highly personalised. All the entries are relevant to you, shows you already watch and the shows you might like. Any time you open this guide it knows what time it is and tells you exactly what you should watch.”

Iskold goes as far as to call the new GetGlue “the first truly social guide” since each entry tells you which of your friends is also watching, which show is trending overall among the user community. “Social is this big layer we weave in on top of everything,” he says.

When GetGlue announced its US$12m funding in January, it also said it had clocked up two million users. This was a 1,000% increase on where the company was a year earlier. With the arrival of GetGlue for iPad, the firm said it had hit the three million mark, generating 500 million “taste points,” meaning half a billion check-ins, ‘likes’ and reviews – valuable data to anyone in the business, surely.

Social media research specialist Trendrr counts GetGlue activity within its metrics alongside data from Twitter, Facebook and another TV app called Viggle.

While Twitter is “the river that runs through almost every social TV applications,” according to Trendrr CEO Mark Ghuneim, and is by far and away the largest driver of social media chatter around TV shows, Iskold says GetGlue outpaces it on a number of counts.

“If you look at stats from services like Trendrr you would see that GetGlue fairs very well compared with Twitter. We certainly don’t have anywhere close to their volume for big events like music awards, Super Bowl or the Olympics but for day-to-day shows like Breaking Bad and True Blood a very significant percentage of tweets are coming from GetGlue – easily up to 30% on any given Sunday or other given day.

“A lot of the activity that is happening on Twitter is coming from us.”

Indeed, the company went as far last month as to claim that it tops Twitter when it comes to scripted primetime TV.

GetGlue distinguishes between “‘social events’ that happen to be on TV,” such as sports and televised debates, and social TV proper, which it defines as scripted primetime dramas and comedies – those with which viewers are genuinely socially engaged.

By splicing television in this way, GetGlue claims that in the latter category it came out ahead of Twitter on four out of the top 10 Nielsen-rated broadcast network shows between April and May this year. The figure rose to nine out of 10 in cable from June to August.

GetGlue says that out of the 15 network TV fall pilots that debuted in September, its users engaged in more social media activity around 14 of these shows than did Twitter users.

These numbers, the firm argues, offer a counter to those who claim that three million users are of little value when up against Twitter’s 150 million or indeed the 114.2 million US households that have TV, according to Nielsen.

Iskold argues that even getting 1% of a TV audience checking into a show would be a major achievement. “Nielsen in the US is 25,000 households,” he says of TV’s establishing ratings measurement firm.

“On a bad day GetGlue has 500,000 check-ins. I can tell you a lot more about long tail of TV from my user base. There’s an audience around True Blood that checks in every Sunday, at least 25,000 people to every episode within a few minutes of it starting.”

He believes GetGlue can grow to “10 or 20 million users in the coming year.”

But the space is changing rapidly. Miso – at one time GetGlue’s nearest rival – appears to be going through something of a strategic transition, while others like Philo have fizzled out entirely. Plenty of others have piled into the space, with Yahoo! buying IntoNow, plus others such as Shazam, Yap.TV, Viggle, Peel, SocialGuide, Flingo, Sidecastr, Dijit, ConnecTV and Zeebox all queuing up.

“Among our major competitors would be Viggle and probably Zeebox,” says Iskold. With the addition of IntoNow and, of course, his own company, he adds: “I think the battle this fall is going to unfold around these four products.”

Of Zeebox, which launched stateside as recently as September, he says: “Backing from Comcast is nice but the reality is users will vote which app is better.”

Prior to Zeebox, Comcast had its own social TV app called Tunerfish, which still exists but hasn’t had any kind of profile since it debuted around the same time as GetGlue two years ago.

Rather surprisingly, Time Warner’s HBO and Cinemax were also among Zeebox’s partners, perhaps suggesting that one of GetGlue’s main patrons itself remains undecided about which horse to back in the fast-moving social TV stakes.

.jpg)